Nineteen establishments were found to have traded Rs38.84 billion in 11 years.

Krishna Acharya, Ramu Sapkota and Shiva Gaunle: Center for Investigative Journalism- Nepal

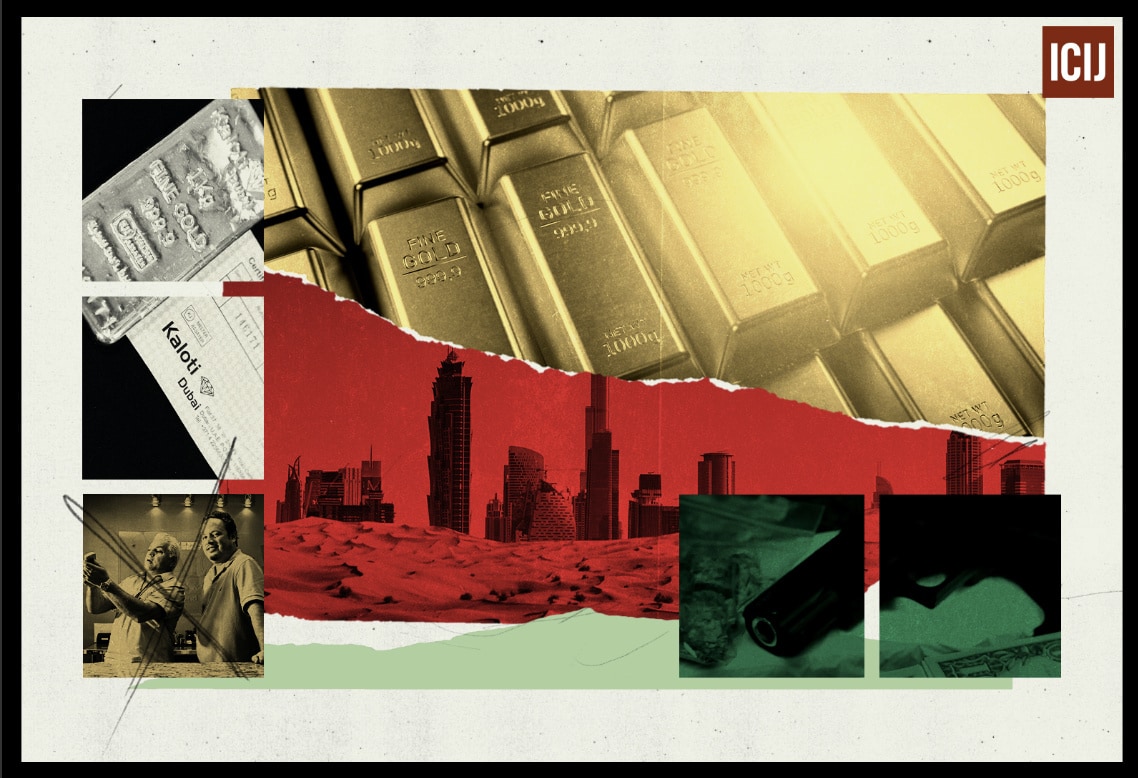

It has been revealed that some companies and banks in Nepal are involved in transferring money obtained suspiciously. On September 20, 2020 (midnight as per the Nepal Standard Time), the International Consortium of Investigative Journalists (ICIJ), an international network of investigative journalists, revealed ‘FinCEN Files’ based on top-secret documents prepared by the ‘Financial Crimes Enforcement Network (FinCEN)’, a government body that monitors financial transactions system in the US.

FinCEN Files is the revelation of transactions from 1999 to 2017. During this period, banks had monitored the suspicious financial activities of their customers and reported to FinCEN. As these reports were obtained by BuzzFeed and ICIJ, they collaborated with journalists in their network around the world, and made divulged findings of ‘FinCEN Files’.

According to ‘FinCEN Files’, between December 2006 and March 2017, nine banks, 10 companies, and various individuals in Nepal were found to have transacted (sent/received) suspicious funds in the name of cross-border trade. This shows that some Nepali business entities are linked to the international smuggling of gold, antiquities, bitumen, and telecommunication equipment. Standard Chartered Bank, Prime Commercial Bank, Bank of Kathmandu, Nepal Investment Bank, Everest Bank, Mega Bank, Himalayan Bank, Apex Development Bank of Kaski, and Nepal Bangladesh Bank are mentioned in the list of banks that are involved in transferring money suspicious.

FinCEN Files shows the involvement of 10 Nepali companies that directly sent or received suspicious funds. Among these are Rauniyar Brothers & Company, Subha Samriddhi Traders Pvt. Ltd., Shasta Trading Company, Setidevi Export Import Pvt. Ltd., L.D. International Pvt. Ltd., Felt and Yarn Pvt. Ltd., Woman’s Paper Crafts, Acme Money Transfer Service, and Sunny Enterprises. Some of these companies were never incorporated but they have brought and sent money in a period of 11 years. In addition, about a dozen Nepali companies were found pulling the strings from behind to make such activities happen. But banks and companies in Nepal have denied the allegations of their involvement in such suspicious transactions or activities.

As per the revelation, a suspicious amount of 292.7 million US Dollars has been transacted through these banks and companies during the period of 11 years. This amount is equivalent to the budget presented by the Gandaki state government in the fiscal year 2020/21.

After examining the documents obtained from ICIJ, the Center for Investigative Journalism (CIJ) Nepal has categorized the transactions into three types.

First, the Center has discovered the total amount of money that was sent or received during 2006-2017.

Second, a lump sum amount of suspicious transactions taking place in various countries of the world, including Nepal, is uncovered. Yet, the exact figure is not clear as to how many of them are linked to Nepal.

Third, the names of individuals and companies who had traded suspicious money abroad using Nepali names, surnames, and addresses have been exposed. In such cases, no financial institutions, banks, and companies based in Nepal seem to be involved.

In the first type of transaction, the total sum of incoming and outgoing amounts turns out to be 177.6 million US Dollars.

Out of this amount, 103 million US Dollars has made a clear exit from Nepal. Likewise, 74.6 million US Dollars has arrived in Nepal.

In the second type of transaction, a lump sum amount of 48.2 million US Dollars is found to be traded or transferred illegally in various countries, including Nepal. The FinCEN Files has mentioned this transaction in the report; however, it is not clear how much was traded through Nepal.

Apart from that, in the third type of transaction, the transfer of 66.8 million US Dollars done by Nepali origin individuals living abroad is unveiled.

FinCEN has placed all three types of transactions in the list of Suspicious Activity Reports (SARs). The analysis of these details clearly suggests that the aforementioned banks in Nepal have failed in their duty to ‘monitor the transactions of each of their customers’. When it comes to the international assessment of money laundering, it has posed serious challenges that could ‘push Nepal towards the list of high-risk countries’ and ‘defame the country’s name even more’.

In the name of various trades, businesses, and transactions, the money has been sent and brought in multiple times in Nepal. Banks have been used to launder money earned from the smuggling of artifacts that have cultural and archeological importance.

Huge flow via Standard Chartered Bank

As mentioned in the FinCEN Files, Standard Chartered Bank of Nepal has brought and sent the largest sum of money in regard to suspicious transactions and transfers. Standard Chartered Bank and its branches abroad have been involved in doing such transactions. In some transactions, other banks have also been used to perform such activities.

Customer – 1, Rauniyar

Among the most suspicious transactions performed through the Standard Chartered Bank Nepal are two companies based in Birgunj Sub-Metropolis-12, Meena Bazaar, Parsa, Main Road. Rauniyar Brothers and Company and Shubha Shambridhi Traders Private Limited. According to the details provided by a source at the Office of Company Registrar, Tripureshwor, the first company is registered under the name of Narayan Ji Rauniyar of Birgunj and his four sons – Shyam Babu, Jyoti Babu, Prakash Kumar, and Deep Kumar Babu.

Photo: Bikram Rai

The second company is registered only in Jyoti Babu’s name who is the son of Narayanji. However, the mastermind behind these distrustful activities seems to be Prakash Kumar Rauniyar who mostly resides in Dubai. FinCEN has mentioned that as per his plan, suspicious transactions were carried out via a Dubai based company called ‘Kite International FZE’, as well as various other shipping companies. Kite’s main business is to import and export petroleum products such as bitumen, engine oil for vehicles, lubricants, and rubber processing oil. Through these dubious Dubai based companies, the Rauniyar family has traded and transferred suspicious money in the name of import and export of bitumen and petroleum products in Nepal.

Rauniyar Brothers and Shubha Shambridhi Traders have repeatedly opened Letters of Credit (LC) from Standard Chartered Bank of Kathmandu between September 28, 2010 and September 4, 2014. During this four-year period, these two companies have sent payments of 71.4 million US Dollars to different countries, including Dubai.

FinCEN has pointed out sensitive facts about these companies. Rauniyar’s company brought the goods from Iran–a country where the United States has imposed a trade ban. However, the documents have been forged to show that the goods have been imported from Dubai.

FinCEN has put it in the list of SARs.

For instance, the transactions that occurred between September 28, 2010, and January 17, 2011, to February 1, 2011 can be taken. To purchase bitumen worth $225,000 from the Kite company, Standard Chartered Bank Nepal had issued an LC on Prakash Kumar Rauniyar’s name on September 28, 2010.

As per the order, the goods were delivered to Djibouti and Bahrain on 28 September 2010 through two shipping companies called ‘MSC Jemima’ and ‘MSC Peggy’. The exported material mentioned in the description is furnace oil. From there, those goods made a final journey to Sirsiya port of Birgunj via Kolkata, as per the documents.

Based on the records, Standard Chartered Bank Nepal had paid $243,554.63 to Kite from January 17, 2011, to February 1, 2011. In October 2016, an UK based non-profit organization called International Maritime Bureau (IBM) had conducted investigations over the LCs of these companies.

IBM investigates all types of maritime crime, fraud and misconduct in international trade. Its investigation has revealed that Nepali companies have performed transactions four times and loaded goods from the ‘Bandar Abbas’ port in Iran. However, the made-up paperwork suggested goods were loaded through the port of Jebel Ali, Dubai. Given this, FinCEN has put it on the list of suspicious transactions.

As mentioned in the company’s website, Kite exists as a group of companies that is stationed in Kenya, Zambia, Mozambique, Nepal and the United States. According to its website, the company has launched a “new project for higher education in Nepal.” But government officials say Kite has not run any projects in the education sector in Nepal.

About this transaction, we tried to get the response from Kite via email. But we did not receive any reply.

Narayanji Rauniyar, one of the directors of the two companies, said that both his companies are currently closed. “There is no company now. It’s been four or five years since it was shut down, ” he said. “We used to import bitumen, but we don’t anymore. ” FinCEN stated that his son, Prakash Kumar Rauniyar, was the mastermind behind the business. Narayanji said that he was abroad and would give his phone number but that did not happen.

Customer- 2, DANA Dairy Group Limited

According to FinCEN, DANA Dairy Group Limited is another customer that has made suspicious transactions by sending money from Standard Chartered Bank, Nepal to Switzerland. On April 7, 2015, 27,672 US Dollar was sent to DANA Dairy Group Limited in Switzerland from Standard Chartered Bank, Nepal. On July 28, 2015, DANA Dairy in Switzerland received only 27,112 US Dollar. DANA Dairy is a company that produces, sells, and distributes dairy products.

According to DANA Dairy’s website, it has factories in 16 countries. DANA Dairy exports its products to 56 countries, including Nepal. There is no mention of the sender’s information and the reason why money was sent from Nepal to Switzerland. However, ‘FinCEN’ has put it on the list of suspicious transactions.

Regarding the banking transactions and the involvement of companies, Pranu Singh, Head of Brand and Marketing (Corporate Affairs) at Standard Chartered Bank Nepal stressed on the bank’s responsibility to keep confidentiality regarding the FinCEN’s Suspicious Activities Reports (SARs). She did not comment on specific cases.

Responding to our email, she claimed that the SAR filing is not a proof of wrongdoing on the part of a Bank, a client or a counterparty.

“The reality is that there will always be attempts to launder money and evade sanctions; the responsibility of banks is to build effective screening and monitoring programmes to protect the global financial system,” she said, “we take our responsibility to fight financial crime extremely seriously and have invested substantially in our compliance programmes.” She claimed that Standard Chartered Bank’s monitoring and investigations work has contributed to the conviction of criminals and the bank’s efforts have been recognised by law enforcement agencies in multiple jurisdictions. But she did not want to comment anything about the companies and their transactions.

We also sent email queries to Dana Dairy Group of Switzerland about the transaction. No response has been received from the company.

Prime and BOK assisted a company involved in selling smuggled gold

According to ‘FinCEN’, the Shasta Trading Company Pvt. Ltd. (address is mentioned as Balkumari of the then Lalitpur Sub-Metropolis-8), was found to have transferred suspicious money to Dubai. At first, the money comes from the US-based Standard Chartered Bank to the same bank in Nepal, and then it ultimately goes to Dubai. Quoting a review done by Standard Chartered Bank’s New York branch, FinCEN has mentioned four foreign companies, including Shasta Trading Company Pvt. Ltd. were found to be involved in suspicious transactions worth 2.7 billion US Dollars between January 1, 2008 and August 29, 2012.

From July 8, 2009, to January 14, 2011, Shasta Trading Pvt. Ltd. has received 31.5 million US Dollars through 53 transactions. As per the FinCEN, the amount has been deposited in Shasta Trading Company Pvt. Ltd’s account at Prime Commercial Bank, New Road, and Bank of Kathmandu, Kamalpokhari. But the details of amounts deposited in each bank are not specified in the documents.

The origin and purpose of the money transfer are not clear but later Shasta has sent this money as a payment to Dubai based Kaloti Jewellery International DMCC and Hong Kong-based Adit Overseas. An amount of 30.7 million US Dollars was sent to Kaloti Jewellery between July 27, 2009, and January 14, 2011, for the import of biscuit-shaped gold and silver. Shasta sent the remaining $872,689 to Adit Overseas on August 7, 2009, and April 8, 2009.

As per the records kept by FinCEN, the suspicious transaction of gold alone was more than 514.9 billion US Dollars. According to FinCEN, the Kaloti Group, which traded gold with Nepal’s Shasta Trading Pvt. Ltd for as many as 4,557 times from 2007 to 2015, was party to suspicious transactions worth 9.3 billion US Dollars.

According to leaks in 2014, Kaloti Jewellery mainly purchases gold used in smuggling, criminal activities and conflict. In 2012, Kaloti had paid 5.2 billion US Dollars in cash to buy gold. Just to prevent others from identifying suspicious money, the company has used cash to buy gold while making transactions through various banking systems.

FinCEN Files has revealed that Shasta Trading Pvt. Ltd of Nepal traded gold with the same company. According to the OCR Nepal, Tripureshwor, the investors in Shasta are Shanti Prabha Tuladhar, Trikaldhar Tuladhar, Tribhuvandhar Tuladhar, Tulsadhar Tuladhar and Samyakdhar Tuladhar of Kathmandu Metropolis-27.

Among the mentioned share members, Tribhuvandhar Tuladhar looks after the main business, a source close to him told CIJ Nepal. Tuladhar is also the chairperson of the Nepal China Chamber of Commerce and Industry. When contacted, Tuladhar said he was in a meeting and would call in an hour. After repeated attempts, he did not answer the phone.

Regarding the transaction, Prime Bank’s Information Officer Amrit Charan Shrestha said that no suspicious transactions were ever carried out by the bank as the bank complies with the rules set by Nepal Rastra Bank (NRB). “Shasta Trading Pvt. Ltd is an old customer of our bank. The company only opens LC from our bank to import silver. The company also does business with many other banks, so if there might be some irregularities via other banks, i do not know. As far as the BOK is involve, the have been clean” said Shrestha, “We have acted in accordance with the rules of the Rastra Bank, and they have never informed us about SAR.”

Mahesh Mishra, information officer of Bank of Kathmandu, did not want to talk much. “I don’t know anything about it,” he said. If anything happens, I’ll call you later. “

Responding to ICIJ, Dubai’s Kaloti Jewellery, which is linked to the deal, denied the allegations.

The bonding of Investment Bank and ZTE

According to FinCEN, Zhongxing Telecommunication Equipment (ZTE) Corporation, China’s largest telecommunications service provider company, remitted 213.3 million US Dollars to other countries, including Nepal, from March 17, 2011, to March 1, 2017.

ZTE had done the transaction through Beijing-based China Construction Bank. The US-based New York branch of China Construction Bank had discovered that the transacted amount was suspicious. In the duration of three years and four months from November 4, 2013 to February 27, 2017, ZTE was found to have deposited some amount in Nepal Investment Bank, according to ‘FinCEN’. In the description, four separate amounts: $5,709.09, $5,244.76, $40,357.75 and $10 are found to be deposited by ZTE Corporation in Nepal Investment Bank, Kathmandu.

Zhongxing Telecommunication Equipment (ZTE) Corporation in Beijing. Photo: VCG

According to FinCEN, citing various media outlets, the five-year-long investigation mentioned “several conspiracies” that the ZTE created to evade US sanctions. The company “makes the purchase of telecommunications equipment from the United States and sells it illegally to Iran as ZTE’s equipment.” According to FinCEN, the ZTE traded suspicious funds in various countries to deceive regulating bodies against US sanctions.

ZTE is one of the leading exporters of telecommunication equipment in Nepal. Soon after the Gorkha Earthquake of 2072 B.S, ZTE was importing materials for constructing a tower for Ncell–a telecommunication company based in Nepal. The purpose of the import was commercial, but it’s intention was to bypass customs duty, where it tried to bring goods by sticking Red Cross stickers on the imported goods. After it was discovered during the customs inspection, ZTE had to pay 10.1 million rupees to release its goods.

Bijendra Suwal, Deputy General Manager of Nepal Investment Bank, said that the so-called suspicious documents should be sent for response. He said that the bank could not disclose the relationship between the bank and the customer as per the Banking and Financial Institutions Act, 2073 BS. “Due to a lack of proper evidence, we are unable to disclose information about our customers owing to privacy obligations,” he said in a reply email.

We emailed ZTE in this regard but no response was received.

Everest’s support to ‘Setidevi’

An amount of $100,000 appears to have been transferred to Nepal on December 10, 2013, from the account of Anglotron Inc., Tortola, British Virgin Islands, a well known tax haven country.

According to ‘FinCEN’, the money was sent to Standard Chartered Bank in New York by Commerzbank AG of Frankfurt, Germany. Then that amount was transferred to the Everest Bank, New Baneshwor from New York which was ultimately received by Setidevi Export Import Pvt. Ltd. in Thamel, Kathmandu.

Following the same process, on February 5, 2014, Setidevi Export Import Pvt. Ltd. received $65,000. On August 14, 2014, the company again received an amount of $120,000, according to ‘FinCEN’. The three-time money transfer to Setidevi was in return for ‘textile export’. ‘FinCEN’ has put it on the list of suspicious transactions.

Keshav Raj Poudel, information officer at the Everest Bank, said that only Nepal Rastra Bank can be informed about the customer’s confidential details. “It’s a secret which you’re trying to understand. It is supposed to report to the Nepal Rastra Bank. I don’t have the right to say that, “said Poudel, however, I have forwarded your query to our bank system.”

4 million rupees to Seychelles through Mega

According to ‘FinCEN’, L.D. International Pvt. Ltd. of Kathmandu sent 4 million rupees ($33 798.75) to Habib American Bank of America through Mega Bank on May 22, 2015. Through Indonesia’s PT Bank Internasional Indonesia Tbk, the money was received by Equity World Limited Seychelles–another country famous for being a tax haven.

The money that exited Nepal was to be for importing goods. Though ‘FinCEN’ mentioned SARs in regard to this case, the import of goods and its purpose are not clear. The Nepali company L.D. International Pvt. Ltd. involved in this deal, is registered under the name of Saurabh Kumar Agrawal, son of Damodar Prasad Agrawal of Morang. Saurabh is a resident of Kathmandu Metropolis-1.

In this regard, Saurabh said that none of the transactions of his company were suspicious. “We are doing business through the bank by opening an LC as per the rules,” he said, “We haven’t done anything upside down. Since we’ve been doing business for 20 years, we are 100 percent right.” Saurabh said that the company has been selling the chemicals imported from India and other countries.

BOK and Himalayan Bank

On November 20, 2015, an amount of $127.79 was deposited in Standard Chartered Bank of New York by Commerzbank AG of Frankfurt, Germany. The amount was received by Sunita Sherpa through Bank of Kathmandu, Nepal. Through these banks, $429.10 was deposited in Sunita’s name on December 14, 2015. On the same day, another $710.31 came in Sunita’s name through a similar process. ‘FinCEN’ also listed it as a suspicious business.

According to the OCR Nepal, ‘Felt & Yarn Pvt. Ltd.’ is registered in Sunita’s name. Suspicious amounts have been deposited in the name of this company through Himalayan Bank on different dates. As per the FinCEN files, the transfer occurs eight times on multiple dates where the money is first sent to Standard Chartered Bank of New York from Commerzbank AG of Germany, and it finally comes to the account of ‘Felt & Yarn Pvt. Ltd.’ at Himalayan Bank, Kathmandu. This is how the company has received a total of $9,985.

On eight different dates (30 October 2015, 9 November 2015, 16 November 2015, 20 November 2015, 15 January 2016, 20 January 2016, 22 January 2016, and 1 February 2016) the total amount that came into Nepal was $79,880. FinCEN has mentioned that “the bank did not monitor or deny the amount, even though it was suspicious”.

Bank of Kathmandu’s Information Officer Mahesh Mishra did not want to talk much. “I don’t know anything about it,” he said. If anything happens, I’ll call you later. “

Sushil Joshi, Information Officer of Himalayan Bank, told CIJ Nepal to reach out to Bhavani Ghimire who according to him was a more informed and relevant person to talk with. Ghimire said, “We don’t have any information and we can’t say anything about the customer.”

Sunita Sherpa, an investor in the company that brought the money to Nepal, said she did not know why it was called suspicious. “We are also doing business in the United States by opening a company. We have completed all the legal procedures and tax issues, ‘she said. According to her, the company makes 5,000 kinds of materials by bringing New Zealand sheep wool in Nepal which is sold abroad. “Our team of 100 employees does it,” she said. Last year, we had a turnover of 150 million rupees.”

A spokesman for Commerzbank AG of Frankfurt, Germany said they did not want to comment on its customers and transactions due to the Banking Privacy and Asset Laundering Act.

Another support of Bank of Kathmandu

Analyzing the details obtained from FinCEN, the Bank of Kathmandu (BOK) seems to have deposited suspicious amounts in ‘Woman’s Paper Crafts’ company in Nepal. This company does not appear to be registered with the OCR Nepal. However, on November 6 and 20, 2015, the company received $871.99 and $724.60, respectively. Both of these amounts were first sent to Standard Chartered Bank of New York from Commerzbank AG of Germany, and then the money reached the Bank of Kathmandu, Nepal.

Following the same route of banks, on December 3, 2015, ‘Woman’s Paper Crafts’ received $1146.59. On December 22, 2015, the company received $1,152.88 and $621.52 was received on January 8, 2016 through the same banks.

The Office of Company Registrar Nepal maintains the records of registered companies. But while searching for ‘Woman’s Paper Crafts’, the information was not found on the website.

Bangladesh Bank’s cooperation to Jindal

Naveen Jindal. Photo: Hindustan Times

New York-based Deutsche Bank Trust Company Americas (DBTCA) discovered between that May 6, 2016 and December 1, 2016, Jindal Steel and Power Limited of India has been involved in transactions worth 40.2 million US Dollars. The transactions have occurred 116 times between

Twelve foreign companies, including Jindal Steel and Power Limited, and Nepali company ‘Nepal Investment’, are involved in the business. The involvement of Nepal Bangladesh Bank and 19 other foreign banks in this transaction has been revealed.

Headquartered in New Delhi, India, Jindal Steel and Power Limited also has a branch in Beijing, China. Its founder is Naveen Jindal, a former Lok Sabha MP from Kurukshetra, Haryana, India. According to FinCEN, “he is accused of criminal breach of trust.”

According to Business Standard magazine on January 20, 2013, Naveen Jindal had planned to invest 15 billion Indian rupees (equal to 24 billion Nepali rupees) in the Upper Seti Hydropower Project in Bajhang. After taking a license, the company put the project work on hold for a prolonged period. Due to this reason, the Nepal government revoked its registration in 2010.

In this regard, Bangladesh Bank’s Information Officer and ‘Operations Head’ Suresh Devkota said that he had heard the name of the company for the first time. “It’s the first time I’ve heard the name of that company. We have to find out if any transaction has happened in our bank or not,” he said. I have to search for it. If we get any information, I will tell you.”

Suspicious money from Iraq

On February 16, 2016, Husam Hatif Noor, a resident of Iraqi Kurdistan, transferred $1,220 to Koisi Sherpa, a resident of Boudha, Kathmandu. However, Sherpa received only $1175.997 in Nepal.

The money was sent through Al Nibal Al Arabeya for Money Transfer in Baghdad, Iraq to Acme Money Transfer Service of Boudha, Kathmandu. Acme Money Exchange is registered under the name Rajesh Lama, son of Man Bahadur Lama.

On March 5, 2016, Qays Najat Jalal transferred $820 to Asman Ghising through Al Nibal Al Arabeya. Of that amount, $788.89 was paid through Sunny Enterprises, a company based in Kapan, Kathmandu. However, the company is not registered with Kapan as an address, according to the Office of the Company Registrar.

On February 1, 2016, Bikram Gurung remitted $270 to Nepal through Al Nibal Al Arabeya. Shanta Gurung received $254.86 through the Apex Development Bank’s branch office in Pokhara-1, Harichaur, according to FinCEN reports. Apex Development Bank has now merged with Nepal Credit & Commerce Bank, Limited.

On January 10, 2016, Bikram sent another $1500 to Mustafa Husamadin F Khudhur through the same Iraqi money transfer company. Khudhur received that money from IBAG Money Transfer’s Montazah branch in Alexandria, Egypt. Bikram again sent another $410 to Sarab Jaafar. Jaafar appears to have received the money through Högdalen Kiosk Company based in Stockholm, Sweden.

Since Sunny Enterprise, a company, is found to be involved, it is suspicious that the money sent from Iraq might not just be remittance money.

Rajesh Lama, the Acme Money Transfer owner, said that his customers could withdraw money only after submitting the required details, expressing his incognizance about his company’s suspicious transactions. “We pay to the customers only when we get their proof of identity,” he said, “We don’t care about their personal matters.”

Nepal’s connection in lump-sum transfer

According to the ‘FinCEN Files’, lump sum transactions aappear to have been transferred to countries which are infamous for money laundering. For example, DuoDecad IT Services in Luxembourg had transferred $24,712.35 in 15 international transactions between April 7, 2015 and June 22, 2015. That amount was deposited into five different accounts of anonymous individuals from Nepal, Canada, Qatar, Zambia, and Hungary.

From April 7, 2015 to June 22, 2015, DuoDecad IT Services, Société Européenne de Banque SA in Luxembourg, and a client of Payoneer, sent $29,805.23 to various individuals in Nepal, Canada, Hungary, and Luxembourg in 20 transactions. That amount was transferred to multiple individuals in Nepal, Canada, Hungary and Luxembourg.

DuoDecad IT Services’ office.

From December 2, 2014 to March 23, 2015, DuoDecad IT Services, Société Européenne de Banque, a Payoneer client, and UniCredit Bank AG of Germany transferred 29.9 million dollars in 47 transactions. Of those, DuoDecad transferred money to different individuals from Nepal, Jordan, Belize, Canada, Hungary, Earthport, United Kingdom in 36 transactions.

DuoDecad had transferred 11.1 million dollars in 152 transactions using various Payoneer accounts. The money transferred to multiple individuals and organizations in Nepal, Costa Rica, Singapore, Romania, China, Russia, Canada, the USA, Germany, Ukraine, Poland, Seychelles, Kazakhstan, Uganda, Hungary, Bangladesh, Guatemala, the Netherlands, and the Philippines.

FinCEN has listed all of these transactions as suspicious. FinCEN noted that the transactions were carried out through Nepal, India, Pakistan, Lebanon, Russia, Ethiopia, Egypt, Nigeria, Cambodia, Cameroon, Uganda, the UAE, Bahrain, Rwanda, and Afghanistan – the countries at the high-risk for money laundering.

Similarly, MS Security, LLC — a security services company based in Kentucky, United States — is involved in various transactions. The signatories of the company’s bank account are Yacoub A. Sidya and Ismael Pino. Through MS Security, a total of 1.7 million dollars has been transferred to Nepal and other countries with high risks of money laundering. According to the FinCEN, 1st Financial Bank of the United States and other banks have been involved in such transactions.

Records show that the concerned banks’ anti-money laundering monitoring system had alerted them about the transactions. According to the banks’ review of the transactions, between October 18, 2013 and February 11, 2014, 120 suspicious transactions with a minimum of $300 to a maximum of $100,000 have been made and a total of 1.1 million dollars transferred.

Among those, most of the transactions were smaller payments flagged as suspicious and sent monthly to various individuals in West Africa. Those wire transferred smaller amounts have eventually gone to the multiple people in Nepal, South Africa, UAE, France, China, Spain, Republic of Ireland, UK, India, Netherlands, and Mauritania.

DuoDecad IT Services of Luxembourg did not respond to requests for comment.

Opaque transactions

From October 8, 2015 to May 16, 2016, Affluent Epoch Ventures, a company from Edinburgh, Scotland, had made 56 transactions to send money to several financial institutions in various countries. It had remitted 3.6 million dollars from its account at Reģionālā investīciju bank in Riga, Latvia and Novikombank in Moscow, Russia.

3.6 million US Dollar was remitted to banks and financial institutions in Nepal, China, Hong Kong, United States, Russia, Denmark, Colombia, Thailand, Panama, Turkey, Israel, Belgium, Germany, Vietnam, and the Netherlands.

The Bank of China in New York has stated that those transactions were suspicious, according to the FinCEN reports. According to the bank, those transactions did not seem to be intended for finance, trade, or legal purposes.

Antiquities smuggling and illicit earnings

FinCEN’s two separate reports have found that illicit earnings are linked to Nepal’s antiquities smuggling. The report states that Standard Chartered Bank, New York, suspected that Nancy Wiener, one of the antiquities dealers in the United States, was involved in suspicious financial activities.

The FinCEN reports mentioned that Nancy Wiener Gallery and several other companies were involved in illegal trade with international smugglers who have stolen ancient artifacts worth millions of dollars. According to ‘FinCEN Files,’ Subhash Kapoor, an Indian national and the Art of the Past Gallery owner in New York, used to facilitate artifacts smuggling from India to the United States.

Art dealer Nayef Homsi

While in New York, Kapoor was accused of running an international antiquities trafficking ring that trafficked in thousands of stolen artifacts, valued at 107 million dollars, according to leaked reports. Kapoor was arrested by Interpol on October 30, 2011, from Frankfurt International Airport in Germany on the same charges.

Between March 23, 2010 and March 2, 2017, some companies, including Nancy Wiener Gallery, were involved in 413 transactions worth 27 million dollars. Nancy Wiener Gallery alone transferred $150,000 to Pantheon Limited in the United Kingdom and Hongkong.

The same Nancy Wiener Gallery in New York sold 16th-century bronze from Nepal, according to an invoice for a transaction dated March 16, 2010. According to the FinCEN, a person named Nancy Weiner Hamill from the United States transferred $150,000 to Pantheon Worldwide Limited. The transaction documents mention that Nancy Wiener would work both as a receiver and a remitter of funds.

The documents read: “invoice dated March 16, 2010 for a 16th-century bronze,” “half share of sale of 17th century Arhat (Buddha),” and “payment for Kangra painting of Rama, Sita and Laxman in the forest”. “The transactions appear to be related to antiquities that were potentially purchased and sold illegally,” said FinCEN’s documents. “Remittances refer to Tibet, India, and Nepal which ties into the region of East Asia.”

It suggests that antiquities’ illegal trades have been used as a modus operandi to whitewash illicit earnings.

Another company, Pantheon Worldwide, has been involved in amassing money to buy a Nepali Thangka painting and a 38-centimeter-tall 2nd century Gandharan head of a Bodhisattva. FinCEN’s secret records show that from June 2012 to March 2013, Nayef Homsi, an art dealer in Brooklyn, New York, sold ancient religious artifacts stolen from temples in Nepal and India for about $500,000.

“These transactions [were] likely used to facilitate the illegal transfer of artwork,” according to the FinCEN reports. According to a review by FinCEN, Nayef Homsi LLC has received $3.6 million from a company called Pantheon.

A legal advisor of Subhash Kapoor said that Kapoor could not comment on this matter as he was undergoing treatment, according to Shyamlal Yadav, an ICIJ affiliated Indian journalist.

Nancy Weiner did not respond to a request for comment.

Nepali names and addresses

About a dozen Nepalis doing business abroad or with Nepali names or addresses are found to have been involved in the suspicious transactions, according to the ‘FinCEN Files’. A review of transaction documents by Standard Chartered Bank of New York found individuals with Nepali names living abroad involved in suspicious financial dealings.

According to ‘FinCEN Files,’ the transactions made by Global Money Transfer (GMT) in the United States also raises concern for money laundering and suspicious wealth. The bank identified that GMT had remitted a total of 33.9 million dollars in 931 transactions from July 1, 2013 to September 13, 2013.

Nepal Oil and Gas Services Limited in Nigeria.

According to ‘FinCEN Files’, GMT used Israel’s Israel Discount Bank Limited to transfer the money where Standard Chartered Bank, New York, was also involved. It was only on November 22, 2013, that Standard Chartered Bank found out that the transactions were suspicious.

People with Nepali surnames and having connections in Hong Kong were involved in suspicious transactions made possible through Global Money Transfers (GMT). Between July 1, 2013 and September 12, 2013, Advance Business International Limited, based in Hong Kong, received 4.8 million dollars.

Advance Business received the amount through Hang Seng Bank Limited, a Hong Kong-based banking and financial services company. Tika Bahadur Chaulagai had transferred that amount through JPMorgan Chase Bank in New York, FinCEN records show.

Chaulagai seems to have made a similar transaction in 2013 through Chase Bank in New York. Dynamics Hong Kong Limited of Hong Kong received 3.7 million dollars in 19 transactions from September 3, 2013 to November 12, 2013. The money was withdrawn from Wing Lung Bank of Hong Kong.

Three individuals with Nepali surnames are also involved in another transaction. Kul Chandra Rimal, Ram Bahadur KC, and Tenjeen Sherpa transferred the money to Hong Kong through Chase Bank in New York, according to the FinCEN reports. Gurkha Multy Sewa International Limited in Hong Kong received $899,792 in 11 transactions from August 19, 2013 to November 12, 2013. That amount was withdrawn from Hong Kong’s Industrial & Commercial Bank of China Asia Limited.

Similarly, Keycollect, a payment service provider in Switzerland, received $186,958 in 11 transactions from August 14, 2013 to November 4, 2013. The amount was received through a UBS AG, a bank based in Zurich, Switzerland. The money was sent by Sendang Jung Khadka, Binod BK, and Raji Bishwokarma through UBS AG’s branch in Washington DC.

Nagendra Kumar Limbu, who has an address in Hong Kong, received $60,000 on August 19, 2013 in the account of Bank of China Hong Kong Limited. Kul Chandra Sharma sent that money from the Bank of China in New York. FinCEN has mentioned that suspicious financial activities have been carried out by a foreign company established under a Nepali name.

Nepal Oil and Gas Services Limited, a company established in Nigeria, was involved when Eteleson Merchant Limited, another Nigerian company, made a suspicious transaction of 20 million dollars between December 18, 2006 and May 10, 2012. Nepal Oil and Gas Services Limited, a company registered in Nigeria in 2004, trades and supplies petroleum products.

Nepal Fly Limited, a subsidiary of Nepal Oil and Gas, appears to have been registered in 2017 at the Company Registrar’s Office. According to its website, the company was set up by a foreigner. Sources in Nigeria have asserted that “Nepalis living in Nigeria may have been involved in the company”, but their assertions could not be confirmed.

Australia has also been involved in some controversial transactions.

According to the ‘FinCEN Files,’ Kathmandu Pty Limited had sent 2 million dollars to Sinoway Industrial Limited in Australia, through the Commonwealth Bank of Australia. For that, 20 wire transfers were made between December 1, 2014 and December 6, 2015. Hong Kong and Shanghai Banking Corporation, Bank of China, and Deutsche Bank Trust Company Americas were also involved in such transactions.

Kathmandu Pty Limited is a South Melbourne-based company, according to LexisNexis, an American company that provides business and legal services. Kathmandu Pty is an online and retail seller of sports clothing.

Violation of law

The Money Laundering Prevention Act, 2064, requires banks and financial institutions to report suspicious transactions to the Nepal Rastra Bank’s Financial Information Unit (FIU). These banks must “monitor their customers’ financial activities such as account operations, financial transactions, contingency transactions beyond the prescribed limit, and fund transfer through electronic means.”

The Act bars clients from making transactions under anonymous or fictitious names. There is a legal provision to identify the actual person if one tries to make a transaction with a fictitious name or on someone else’s behalf.

Nepal Rastra Bank. Photo: Wikimedia

Financial institutions should also keep a separate record of “transactions of high-ranking officials” in the political, administrative, and judicial spheres. Financial institutions can ask for the transaction details with the concerned entity to identify the actual person or even work together with a third party for an investigation. The records of such transactions should be kept safe for five years.

Despite most of the transactions mentioned in ‘FinCEN Files’ are suspicious and are made through shady entities from countries infamous for money laundering, Nepal’s banks are letting the transactions happen frequently, violating the provisions in the money laundering prevention act.

Such offenses are punishable under the prevailing law.

According to the law, firstly, Nepal Rastra Bank can issue a written warning. “In case of violation of Act or the rules made under the Act or the directives are given, casino operators and financial institutions will be fined Rs. 1,000,000 to Rs. 50,000,000, and other indicative institutions will be fined Rs. 100,000 to Rs. 10,000,000,” says Clause 7 (Pha) of the Money Laundering Prevention Act, 2064. “[Violations may result in] the partial or complete ban on transactions, business or profession, or to suspend or revoke license and registration.”

According to the FinCEN records, the financial institutions have also violated the international norms on money laundering. It has been found that Nepalis’ suspicious financial activities are linked to Iran, North Korea, and Cuba — the countries which have been facing trade sanctions from the United States. Financial Action Task Force (FATF), an intergovernmental organization, has also listed these countries at a high risk of money laundering. As a FATF member, Nepal is supposed to avoid financial transactions with these ‘high-risk’ countries.

Nepal Rastra Bank Governor Maha Prasad Adhikari said that the actions had been taken against the banks that failed to report or monitor their customer’s financial activities. He made three different remarks to our questions:

- “Nepal has enacted laws against money laundering per international standards. The government has set up a Financial Information Unit (FIU) at the Nepal Rastra Bank and a separate department to investigate money laundering. However, having legal provisions doesn’t mean that money laundering will not happen. We don’t claim that we are good at implementing laws, but it’s getting better as time passes.

- Such incidents are more common in countries with weak governance. We are still far away in cashless transactions. We neither have advanced national identity cards that keep all the transaction details of a person. Moreover, the National Risk Assessment Report on Money Laundering and Terrorist Financing has highlighted some serious problems. So, we now have a roadmap to combat money laundering and improve national financial health.

- We have fined six banks and financial institutions about one million rupees for mishandling Know Your Customers (KYC) forms and failing to monitor and report money laundering issues. We have strict laws and the Nepal Rastra Bank is committed to preventing money laundering. There won’t be any ifs or buts.”

What is ‘FinCEN files’?

Banks and financial institutions in the United States should monitor their customers’ activities in doing business if they try to whitewash their illicit earnings or commit other financial crimes.

When some suspicious financial activities occur, U.S. banks and financial institutions must notify the Financial Crimes Enforcement Network (FinCEN) — a bureau of the United States Department of the Treasury that claims to safeguard the financial system from illicit use and combat money laundering — within 60 days.

Based on the information provided by banks and financial institutions, FinCEN gathers more than one million Suspicious Activity Reports, known as SARs, on financial transactions and smuggling every year.

The Financial Crimes Enforcement Network’s office (FinCEN). Photo: Scilla Alecci/ICIJ

‘FinCEN Files’ is a collection of such secret financial records, obtained by BuzzFeed News and shared with the International Consortium of Investigative Journalists (ICIJ) and other news organizations.

BuzzFeed News had shared 2,657 files, including 2,121 suspicious activity reports, or SARs from FinCEN to the ICIJ. After a 16-month investigation, ICIJ has revealed the “FinCEN Files,” collaborating with BuzzFeed News and other media partners.

During the investigation, more than 400 journalists from 110 news organizations in 88 countries, including BuzzFeed News and ICIJ, reviewed additional documents. They obtained 17,641 financial records from multiple sources and filed Right to Information (RTI) applications.

Suspicious financial transactions of a total of 2.99 trillion dollars were reported to FinCEN between 1999 and 2017, according to records sent to FinCEN.

According to a study report on organized crime and illicit drug trafficking by the United Nations Office on Drugs and Crime (UNODC), cited by ICIJ, criminal proceeds amounted to 3.6 percent of global Gross Domestic Product (GDP) in 2009.

2.7 percent of the global GDP money (or $1.6 trillion) was laundered that year.

“According to the statistical analysis, 2.7 percent of the global economy is laundered money,” ICIJ revealed. “This money was laundered through the international financial system. That is an equivalent of 2.4 trillion dollars now.”

FinCEN, a bureau of the U.S. Department of Treasury that gathers information about the suspicious financial transactions, declined to comment when ICIJ and other news organizations made requests. Instead, FinCEN issued a statement on September 1, 2020, saying that it was aware of various media outlets’ attempts to publish reports on Suspicious Activity Reports (SARs) and other sensitive government documents from several years ago. FinCEN said that the unauthorized disclosure of SARs would be a crime that can impact the United States’ national security. “FinCEN has referred this matter to the U.S. Department of Justice and the U.S. Department of the Treasury’s Office of Inspector General,” FinCEN stated.

Contributed by- Arun Karki and Pramod Acharya

Note:

- The exchange rate of one U.S. dollar is calculated at Rs. 119.

- ICIJ’s calculations of the amount may not match ours as they only included the more significant transactions.

- We could not establish contact with some institutions and individuals whose transactions flagged as suspicious. We might consider incorporating their responses even after publishing this story.

*Corrigendum:

An earlier version of this story erroneously mentioned that Seti Devi Export-Import Pvt. Ltd was not listed in the Office of the Company Registrar. CIJ-Nepal regrets the error and requests all media platforms that carried the story to rectify the error. CIJ-Nepal would like to clarify that Seti Devi’s transactions have been termed suspicious not on the basis of the company’s registration status, but owing to the fact that the company has found a mention in the FinCEN files as having done suspicious transactions.

Good JOB Fincen files & ICIJ Teams, Keep it up. This all is dirty money