An international investigation has revealed how many Nepali business persons and companies have used tax havens to stash wealth and avoid taxes.

Krishna Acharya, Ramu Sapkota | CIJ, Nepal

A number of prominent Nepali business persons and companies are involved in clandestine investments and transactions involving the buying and selling of shares by setting up shell companies in tax havens – countries that are known to make it easy to hide ill-gotten wealth. The ‘Pandora Papers’, a global investigation by the International Consortium of Investigative Journalists (ICIJ), in collaboration with more than 140 media outlets around the world, has identified Chaudhary Group and Golchha Organization, among others, as involved in such activities.

According to documents provided to the Center for Investigative Journalism Nepal (CIJ) by ICIJ, a network of international investigative journalists headquartered in Washington, D.C., Binod Kumar Chaudhary, a member of the federal parliament and Nepal’s sole dollar billionaire, has established companies in the British Virgin Islands (BVI), a known tax haven country, under his and family members’ names – his wife Sarika Devi, and three sons, Nirvana, Varun, and Rahul.

ICIJ

Offshore companies in the British Virgin Islands have also been discovered in the names of individuals associated with the Golchha Organization, another big business house. These individuals include Golchha Organization chairman Lokmanya Golchha, his two brothers Mahendra Kumar Golchha and Diwakar Golchha, their cousin Chandra Kumar Golchha and Diwakar’s son Hitesh Golchha.

More companies in tax haven countries were also found in the names of Ajeya Sumargi Parajuli, Arjun Prasad Sharma, and Kishor Rana – Nepalis identified In a previous CIJ investigation into financial records, ‘NepaLeaks’.

Others identified as operating offshore companies from tax haven countries include Rajendra Shakya of Pulchowk, Lalitpur; Sudhir Mittal of Gyaneshwor, Kathmandu; business persons Suhrid Raj Ghimire and Purushottam Poudyal; British citizen Janak Daniel Basnet; and Indian citizen Radhe Shyam Saraf.

Tax havens are countries that offer minimal financial liability, low effective tax rates, and a high degree of secrecy. Investment in such countries is widely believed to indicate an attempt to stash illicit financial dealings or avoid taxes.

The Act Restricting Investment Abroad 1964 prohibits Nepali citizens from investing in any company abroad or even opening up an account in a foreign bank. Any person violating the act “shall be liable to the punishment of fine equal to the amount in question or imprisonment for a term not exceeding six months or both.”

Non-resident Nepalis are also not allowed to invest abroad by taking away money from Nepal under any conditions. A person “who has resided in Nepal for 183 days or more during a continuous period of 365 days” is considered a “resident”, according to the Income Tax Act.

“According to this provision, if a Nepali citizen lives abroad for 183 days and earns an income, they can invest that income there,” said former finance secretary Rameshore Khanal. “Besides this, any investment abroad by Nepalis is illegal.”

According to Gerard Ryle, director of ICIJ, businessmen, leaders, politicians, criminals, and intermediary law firms who open offshore companies are taking advantage of such transactions. In an interview with ABC Australia shortly before the Pandora Paper went public, Ryle said that offshore investments had resulted in reduced taxes and increased inequality and poverty.

“The offshore world exacerbates poverty. It leads to inequality. When countries are robbed of their riches, it leads to all sorts of things like the refugee crisis. This system invites all of the evils of the world, and there doesn’t seem to be a purpose to this system except to enrich some people,” Ryle said in an interview with ABC’s Elise Worthington.

In January 2019, CIJ-Nepal, through its NepaLeaks investigation, had identified the involvement of 55 Nepalis and non-resident Nepalis in offshore transactions. Despite the expose, state mechanisms failed to crack down on tax evasion and money laundering. This inaction appears to be encouraging Nepalis to invest in tax haven countries and also indicates that Nepali politicians could be cooperating with the accused. The direct involvement of Nepali politicians in offshore transactions, however, was not discovered.

The Pandora Papers is an outcome of that surprising silence.

Binod Chaudhary and the Chaudhary Group

(L-R) Rahul Chaudhary, Binod Chaudhary, Nirvan Chaudhary, Barun Chaudhary. Photo: Binod Chaudhary’s twitter.

According to records made available to CIJ Nepal by the ICIJ, the Chaudhary family owns three offshore companies in the British Virgin Islands, one in Singapore, and one in Panama. According to the Pandora Papers, the companies include are Cinnovation Incorporated, CG Hotels and Resorts Limited, and Sensei Capital Partners Incorporated in the British Virgin Islands; CG Hospitality Holdings Global Pte. Ltd.

“The biggest challenge for me was to identify legal loopholes and then to take steps – so that no one can raise legal questions about my foreign investment,” Chaudhary wrote in his autobiography, published in 2013. He then went on to describe utilizing the ‘resident’ provision of the Income Tax Act as a ‘loophole’.

“Nepali citizens living abroad for more than 183 days a year used to be treated as non-resident Nepali, and that person was allowed to invest abroad,” wrote Chaudhary. “I took advantage of this and decided to stay abroad for more than 183 days a year and become a temporary citizen of my own country. Today, my two sons Rahul and Varun are doing business abroad as non-resident Nepalis.”

According to Khanal, the former finance secretary, this is a faulty interpretation of the Income Tax Act.

“This provision does not allow any Nepali citizen to take money out of Nepal and invest elsewhere,” said Khanal. “If a Nepali citizen lives abroad for 183 days, then they can only invest the money they made during that time.”

Furthermore, the investments abroad are not just in Binod, Rahul, and Varun’s names; they are also in the names of his wife Sarika Devi and eldest son Nirvana, both of whom are resident Nepalis. According to the Pandora Papers, all five members of his family have investments in Cinnovation Incorporated while his wife and three sons have investments in CG Hospitality Holdings Pte. Ltd.

According to an official from Nepal Rastra Bank, Nepalis must seek permission from the central bank before being allowed to hold investments abroad. So far, only Binod has applied for permission, said the official who did not wish to be named.

“As [Binod] Chaudhary holds 50,000 gifted shares in Cinnovation, a BVI-based company, he has taken permission from NRB by putting his name on the list of investors,” said the official. “We do not have any details of Binod, Nirvana or Sarika seeking permission to invest in any other company.”

Chaudhary Group responded to these revelations in a short emailed comment. “According to my father who is also Chaudhary Group Chairman, all of our foreign investments are in compliance with Nepali laws. Therefore, we have no further comment on the investigation outlined in your email,” Rahul Chaudhary told the Washington Post’s Peter Whoriskey who was writing on behalf of CIJ-Nepal.

The Golchha Organization

Lokmanya Golchha, his brothers the late Diwakar Golchha and Mahendra Kumar Golchha, his cousin Chandra Kumar Golchha, and Diwakar’s son Hitesh Golchha are all listed as investors in Flatwood Limited, a company registered in the British Virgin Islands. Documents show that they opened the company using their Nepali passports and Nepali address, which is blatantly illegal according to Nepali law.

According to records from Overseas Management, a Geneva-based law firm, the Golchhas have opened an account at Barclays Bank in Switzerland for transactions through Flatwood Limited. Documents show that Diwakar, Hitesh, and Lokmanya Golchha were all authorized by the company on February 12, 2008 to operate that account.

Records also show that in 2008, a group that included Diwakar Golchha decided to buy shares in Nepal’s Eastern Sugar Mills Limited through Flatwood Limited. Flatwood Limited initially bought 1,317.5 shares but after some time, seems to have transferred 384.166 shares to Hulas Metal Craft Limited. Golchha Organization owns Hulas Metal Craft Limited.

Golchha Organization is the oldest business organization in Nepal. Lokmanya, Diwakar, Mahendra, and Chandra Kumar’s fathers are brothers – meaning that the Golchha Organization was founded by their fathers Hansraj and Hulas Chandra. Ram Lal Golchha, the father of Hansaraj and Hulas Chandra, had established Biratnagar Jute Mills.

According to CIJ’s 2019 NepaLeaks, Golchha Organization was the first Nepali company to bring in foreign investment through the British Virgin Islands.

“[Golchha] organization brought foreign investment from Flatwood Limited company for its Nawalparasi-based Nepal Boards Company Limited,” NepalLeaks states. “In 1993, Golchha Organization received permission to bring Rs. 28,868,780 under FDI [Foreign Direct Investment] to produce wooden decorative materials in Nepal.”

According to a CIJ investigation published on July 15, 2017, Eastern Sugar Mills was liable to pay Rs 52.1 million in taxes. However, the controversial Tax Settlement Commission decided that the Mills was only required to pay Rs 400,000 to the state treasury, waiving the remaining amount.

Commission chairperson Lumdhwaj Mahat, Chartered Accountant Umesh Dhakal, and then Director-General of the Inland Revenue Department (IRD) Chudamani Sharma are all facing corruption charges for granting potentially illegal tax waivers.

Diwakar Golchha was a member of the 2008 Constituent Assembly through Nepali Congress party’s proportional representation list. He passed away in April 2019 from renal failure. Diwakar was also the vice-president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) while his brother, Lokmanya Golchha, is the honorary vice-president of the Nepal Chamber of Commerce (NCC).

Ajeya Raj Sumargi

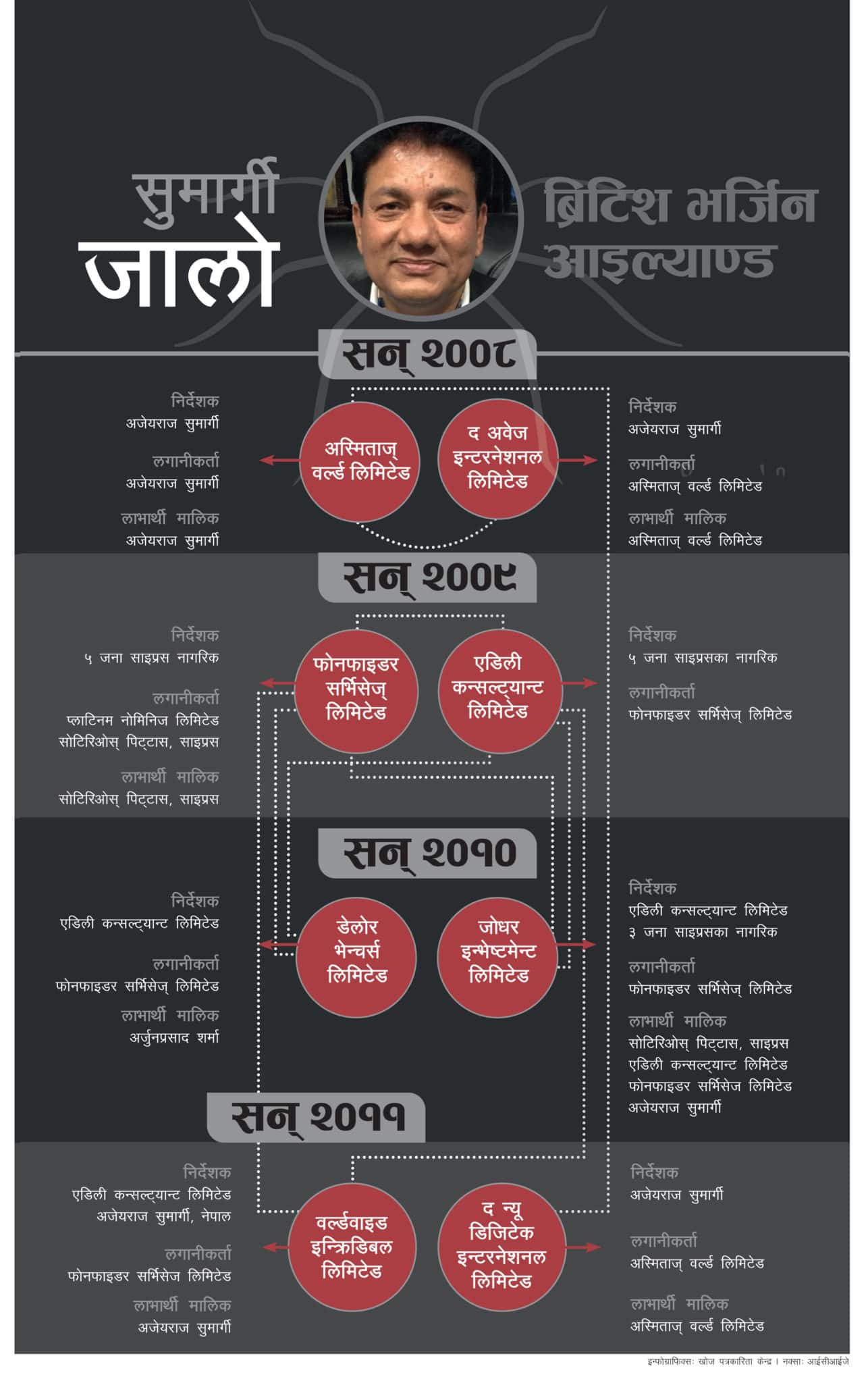

Additional details have now emerged about the offshore transactions of Ajeya Raj Sumargi Parajuli, whose involvement in transferring money from Nepal to offshore companies set up in tax havens and then repatriating the money to Nepal as foreign direct investment (FDI) was previously illustrated on January 16, 2019 by CIJ-Nepal, in collaboration with ICIJ.

Additional details have now emerged about the offshore transactions of Ajeya Raj Sumargi Parajuli, whose involvement in transferring money from Nepal to offshore companies set up in tax havens and then repatriating the money to Nepal as foreign direct investment (FDI) was previously illustrated on January 16, 2019 by CIJ-Nepal, in collaboration with ICIJ.

According to the NepaLeaks expose, Zhodar Investments Limited had funneled a total of $48,372,222 (483,722,210 rupees) to Sumargi’s companies in Nepal.

The Pandora Papers reveals that Sumargi had set up Zhodar Investments in the British Virgin Islands in 2010. Records show that he is the beneficial owner and also the director. Sumargi has a bank account at Hellenic Bank on behalf of the company with signing authority. Sumargi, a resident of Baneshwor, Kathmandu, has mentioned his residential address as the United Kingdom.

According to the Pandora Papers, Sumargi also invested in The Awej International Limited in 2008 and Worldwide Incredible Limited, both in the British Virgin Islands, on September 9, 2011. Sumargi is the director of both companies. Asmita’s World Limited, another company registered in the British Virgin Islands, has invested in The Awej International Limited. Asmita is Sumargi’s wife and it appears that he set up the company under her name. According to documents obtained from ICIJ, Sumargi is a beneficial owner, shareholder, and director of Asmita’s World Limited, which was set up for the sole purpose of establishing a holding company. This company has invested in Hetauda Lime Industry Pvt. Ltd., Everest Mineral Products Pvt. Ltd., and Muktishree Pvt. Ltd, records show. These are all Nepali companies.

Furthermore, Sumargi has also been found to have invested in The New Digitek International Limited in the British Virgin Islands. Sumargi is the director of The New Digitek International while Asmita’s World Limited is a shareholder with 100 units of shares.

The New Digitek is a company that buys and sells shares of internationally renowned companies and trades in telecommunications with permission from various countries. It has also obtained permission to work in Nepal. According to documents, the company aims to hold a 50 percent stake in Nepali companies that provide airtime services for mobile users in Nepal. Nepal Telecom Private Limited Company is the main trading partner of this company.

NepaLeaks previously showed that Sumargi brought 380,000 GBP to Nepal under FDI in 2008 through The New Digitek International to invest in Muktishree Pvt. Ltd., a Nepali company that Sumargi owns.

Arjun Prasad Sharma

Arjun Prasad Sharma, one of Sumargi’s business partners, also has a company in the British Virgin Islands. According to records from Trident Trust, Sharma in 2019 invested in Delore Ventures Limited, a company registered in the British Virgin Islands, on May 12, 2010, using his Nepali passport and address.

Adely Consultants Limited, another company registered in the British Virgin Islands, seems to be the director company of Delore Ventures. Documents show that Fonfidere Services Limited of the British Virgin Islands is a shareholder in Delore Ventures. Fonfidere became a shareholder by buying ordinary shares worth $50,000 in 2010.

A law firm called Soteris Pittas & Co LLC of Cyprus verified the required documents, including Sharma’s Nepali passport, to invest in the company in 2019. The managing director of this law firm is Sotirios Pittas, a Cyprus national who is one of Sumargi’s business partners. Pittas is the director and principal investor in Adely Consultants Limited.

Rajendra Shakya

Rajendra Shakya of Pulchok, Lalitpur, has invested in Gold Time Global Limited in the British Virgin Islands using his Nepali passport. Shakya joined Gold Time in 2010 as the director. Overseas Management Company Trust of the British Virgin Islands appears to be the company registration agent for Gold Time Global Limited.

Shakya is the chairperson of Guna Group, which has invested in real estate, cooperatives, and Guna Airlines. He had undergone a severe financial crisis a decade ago and was even blacklisted for defaulting on loans. A complaint was also lodged against Guna Cooperative, alleging that it had swindled Rs 30 million. Guna Cooperative never returned the money to its depositors.

Suhrid Raj Ghimire and Purushottam Poudyal

Suhrid Raj Ghimire (L) and Purushottam Poudyal.

Suhrid Raj Ghimire, a long-time distributor of Kia Motors in Nepal, and his business partner Purushottam Poudyal are both investors in a company in the British Virgin Islands. Ghimire is the chairperson of Continental Trading Enterprises, the authorized distributor of Kia Motors in Nepal, while Poudyal is the executive director.

Ghimire and Poudyal had set up a company called Grand Spectrum Asset Limited in the British Virgin Islands in 2009. Documents from ICIJ show that they used their Nepali passports to open up the company. Ghimire and Poudyal together opened the company by purchasing three and one unit of share respectively, at the rate of one USD.

Ghimire and Poudyal are also linked to Nepal’s infamous Baluwatar land grab scam. According to a charge sheet filed by the Commission for the Investigation of Abuse of Authority (CIAA) at the Special Court on February 5, 2020, illegally obtained land was registered in the names of Poudyal and Indu Sharma, Ghimire’s mother-in-law. Nearly 300 ropanis of government land in Baluwatar were transferred into private hands with the connivance of politicians, administrators, and businessmen in the land grab.

Of this, 763.11 square kilometers of government land have been registered in the name of Purushottam Poudyal. According to records from the Land Revenue Office, ownership of the 12 aana of land was transferred to Indu Sharma on November 29, 2006. The case filed against them by the CIAA is pending at the Special Court.

Ghimire’s name was also included in ICIJ’s Offshore Leaks in 2013. According to details made public at the time, Ghimire has a company called Echo Bay Limited in the British Virgin Islands. Purushottam Poudyal is an investor in Echo Bay.

Sudhir Mittal

Sudhir Mittal, the owner of Shree Airlines, has been found to have opened a company called Pegasus Air Charters Inc. in the British Virgin Islands by listing Gyaneshwor, Kathmandu, as his address.

According to documents, Mittal, who is the beneficial owner of the company, has also opened bank accounts in the name of the company and has submitted documents stating that he himself is the secondary beneficiary of the company’s property.

Sudhir Mittal. Photo: The Kathmandu Post.

Mittal was also found to have invested in another company registered in the British Virgin Islands called Griffon Asset Holdings Limited in 2006. He is the beneficial owner of the company. For this company, Mittal has listed the United Arab Emirates as his address. Family members, Aditi Gupta Mittal, an Indian citizen, and US citizens Ananya Mittal and Devansh Mittal, also seem to be beneficial owners of the Griffon Asset Holdings.

Trident Trust Limited, registered in Mauritius, is the intermediary law firm that registered Griffon Asset Holdings while The Alchemy Trust is a shareholder. The Alchemy purchased 50,000 units of shares at the rate of one USD. Mittal transferred $200,000 from The Alchemy to Griffon’s bank account, where he and his family members invested. While transferring the amount, accountant Ashok Regmi, with a home address in Gorkha district, was presented as a witness.

Janak Kumar Basnet

Janak Kumar Basnet, a Nepali citizen, has invested in Aster Overseas Limited in the British Virgin Islands. According to documents obtained from ICIJ, British national Janak Daniel Basnet and Irish national Ann Monica Hannon, alongside Janak Kumar Basnet, are the company’s directors.

Documents show that these three have been directors since the establishment of the company in July 2001. Wilhelm Nominees Limited has 100 units of shares in this company while Picasso Limited, a Mauritian company, appears to be the secretary of Aster Overseas Limited. Picasso Limited is allowed to invest 50,000 units of shares at the rate of one USD. Alcogal, an intermediary law firm of the British Virgin Islands, had registered the company.

Janak Daniel Basnet and Ann Monica have been found to have opened a company called Ashgrove Overseas Limited in the British Virgin Islands. Both are directors of the company. Another company in the British Virgin Islands is Globe Chemical Trading Limited, with Janak Kumar Basnet, Ann Monica Hannan, and Daniel Basnet as directors. Documents show that the company’s shareholder is a company called Wilhelm Nominees Limited.

Janak Kumar Basnet and Ann Monica Hannan have been found to have further invested in the British Virgin Islands by forming a company called MDV Telecom Systems Limited and another called Metro Ace Enterprises Limited. Besides them, two foreign nationals (Jane Elizabeth Peters and Yeung Fung Yi) are also directors of this company. The company, which was founded in 2001, was disbanded in 2012.

Janak, Monica, and Daniel were found to have set up a company called Senex Holdings Limited in the British Virgin Islands, after disbanding Metro Ace Enterprises. Janak is an investor in Senex. These three together opened a company called Syncom International Limited in the British Virgin Islands in 2000. Wilhelm Nominees Limited has 100 units of shares in Syncom International. In order to invest in Syncom International Limited, Janak used his Nepali passport, Daniel used British, and Hannan used her Irish passport.

Although Janak used a Nepali passport, he listed his address as Paradise Court in Castletown, UK. His Nepal address seems to be Nijananda Niwas, Sunakothi-1, Lalitpur. However, he is a non-resident Nepali. Janak was a member of the Non-Resident Nepali International Coordination Council from 2005 to 2007. He lives in the Isle of Man, according to information posted on the Non-Resident Nepali Association website.

Kishor Rana

Kishor Rana.

At just 35 years of age, Kishor Rana has set up about a dozen companies in different countries using Nepali passports. According to the Pandora Papers, Rana, who has been living on Sukhumvit Road in Thailand since 2017, established Karna Investment Limited Company through money he earned from trading cryptocurrencies. According to an email conversation between employees of Asiaciti Trust, a Singapore-based law firm, his attempts to open a company did not comply with legal provisions. But Rana managed to eventually open up Karna Investment in Hong Kong on July 25, 2017.

Rana has 20,000 units of shares in the Canadian company Eldorado Gold Corporation, investing a total of $60,029, according to a bank statement issued by the Bank of Singapore on May 31, 2017. Eldorado has invested and traded in various mines in the United States, Europe, and Asia.

Rana also owns 90,200 units of shares in Gold Standard Ventures Corp, purchased for $210,131.724; 100,000 units of shares in Tanzanian Royalty Exploration, purchased for $48,068; 200,000 units of shares in Bonterra Resources Inc., purchased for C$64,132; 150,000 units of shares in Integra Gold Corporation, purchased for C$116,988; 107,500 units of shares in Orca Gold Inc., worth C$46,954.925; 60,000 shares in Pure Gold Mining Inc., worth C$40,983. Pure Gold is one of the world’s largest gold mining companies. Rana also has 10,000 units of share in Canada’s Cameco Corporation, which is the world’s largest uranium trading company. All these details have been extracted from a bank statement issued by the Bank of Singapore on 31 May 2017 in Rana’s name.

According to the same bank statement, Rana also purchased 30,000 units of shares in US-based Uranium Resources Inc. He bought the shares for $59,628 at the rate of $1.98760 per share.

According to Kishor Rana’s biodata, he holds a bachelor’s degree in aeronautical science from Embry-Riddle Aeronautical University in Florida, USA. He then worked as a flight instructor before coming to Nepal in 2014. In 2015, he inherited $10 million from his family, according to his biodata. He owns $3 million worth of real estate in Thailand.

Radhe Shyam Saraf

Indian citizen Radhe Shyam Saraf, an investor in Boudha’s Hyatt Hotel, is the beneficial owner of Pignolo Limited in the British Virgin Islands. Saraf has listed his address as Hong Kong. The company appears to have been founded in 2000.

Radhe Shyam Sharaf. Photo: yakandyeti.com

Ellenborough Global S.A, a company registered in the British Virgin Islands, has invested 100 units of shares in Pignolo Limited while law firm Trident Trust appears to have provided support in opening the company. LED Services Establishment, a Liechtenstein-based company, has 100 units share in Ellenborough. Two Swiss citizens are the directors of Pignolo.

Radhe Shyam, his son Umesh Saraf and wife Ratna Saraf, opened a company called The Devita Trust in Belize in 2006. All three are beneficial owners of the company. Law firm Algocal later registered The Devita in the British Virgin Islands. Radhe Shyam’s other son Arun Saraf also opened a company called The Varunisha Trust in Belize in 2006 which seems to be wholly owned by Arun. Apart from him, the other beneficial owners of this company are Radhe Shyam and wife Ratna.

The Indian Embassy in Kathmandu verified the documents that show Radhe Shyam’s sons’ investment in The Davita Trust and The Varunisha Trust, saying that “no responsibility is taken for the contents of the document(s).”

Radhe Shyam and Ratna opened Saraf Hotels Limited in Mauritius. According to a memorandum of understanding (MoU), on January 10, 2007, Radhe Shyam and Ratna sold the company’s shares to The Varunisha Trust, owned by their son Arun.

According to the MoU, they had given a loan of $14,570.483 to The Varunisha Trust in September 2006 and an additional $9,676.149 in loans to Varunisha between 2006 and 2012. Varunisha paid back $10,712 but the remaining $13,534.632 has yet to be paid back, according to the MoU.

According to documents obtained from ICIJ, Radhe Shyam Saraf sold 2,650 units of ordinary shares to Varunisha at the rate of 1 USD. As Varunisha is an investment company under Saraf, the amount was paid in the name of Saraf Hotels Limited. His wife Ratna also sold the same amount of ordinary shares to Varunisha.

Initially, Saraf Hotels Limited had issued a total of 5,300 units of shares in the name of Radhe Shyam and Ratna. Then, they lent money to The Varunisha Trust as it is a shareholder of Saraf Hotels.