Sagoon Inc, which has already put Rs55 crore in investment by Nepalis at risk, is now raising money in the name of ‘mini IPO’.

Prabesh Subedi and Umesh Shrestha: Centre for Investigative Journalism-Nepal

Sagoon Inc, a Virginia, USA-based company that raised crores in investment from Nepalis living abroad by selling them unrealistic dreams, is now on the verge of bankruptcy. But the founders of the company continue to hide the truth even as they attempt to raise more money.

The company, which started as Delaware Corporation in 2006 and later renamed itself to Sagoon Inc, has not made any income so far apart from the money raised from share investors. This is proven by the official documents it has submitted to the US government.

But the company has released a mini IPO, asking for investments from all over the world. The last date for investment has been fixed at the end of September 2020. Even as it continues to sell dreams that are technically and practically impossible, the company has advertised the opening of the IPO widely and has challenged the existing laws of Nepal. Nepalis living in Malaysia, Gulf countries, Korea, Europe, and America that might make new investments seem to be at risk.

As per the company’s 2019 financial report, its accumulated loss by the end of the year was $93 lakh, or Nrs1 billion. Since the company has not made any income, the loss has become a burden for investors. Most of the investors of the company are Nepalis who live in foreign countries temporarily or Nepali-origin Nepalis who have taken permanent citizenship in various countries.

As per the report submitted by Sagoon to the U.S. Security and Exchange Commission, the company has $11 million in its coffers for regular company operations since December 2019.

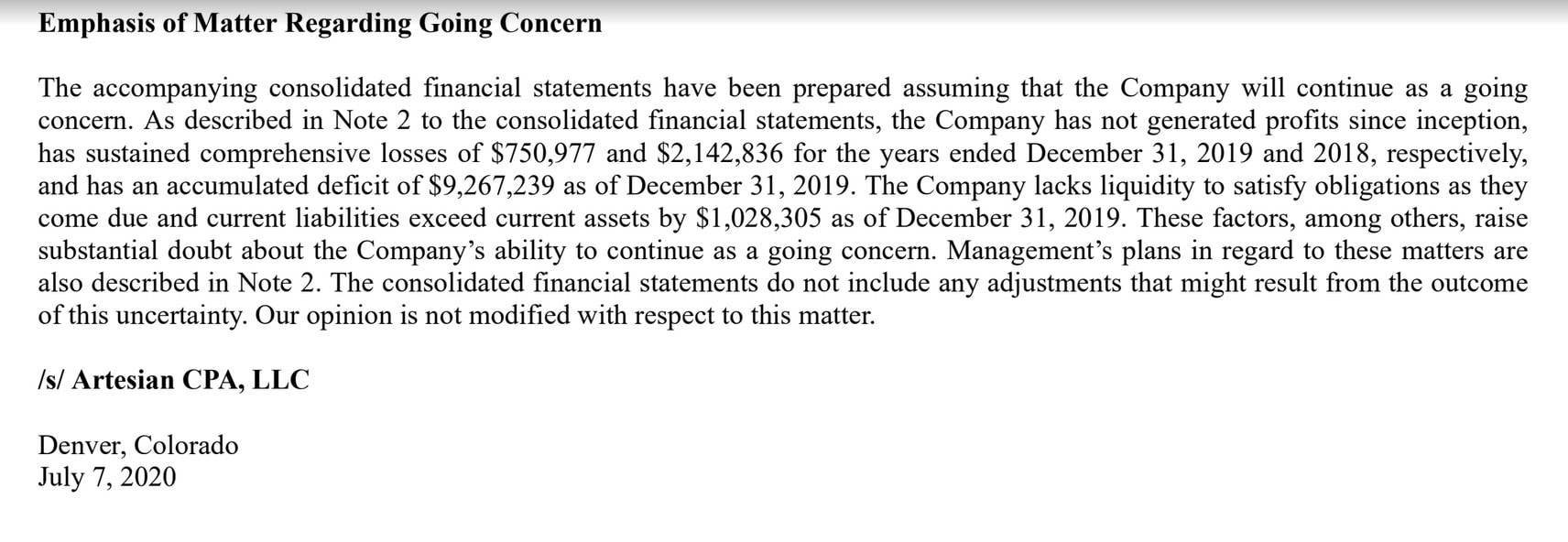

With this amount, the company, which has offices in three countries, cannot even pay for the staff salaries and administrative expenses for two months. According to Artesian CPA, an independent company that conducted an account auditing of the company, there is no basis for the company to move ahead if it does not find a new financial source.

A section of Sagoon’s audit report 2019

CPA, in the 2019 audit report of the company, has said, “The company cannot pay for its liability even with the cash and physical property in its possession. It is doubtable that the company can continue operating in this manner.”

The company’s management itself accepts that it requires $3 million of capital for operating costs for the next 12 months and that it cannot continue operating if it does not receive any IPO investment or loan.

The company raised $5.09 million from 2017 to 2019 through a public call for share investments. Out of which, $4.6 million from 3,600 non-resident Nepalis has been invested. The investors now seem to be concerned about how the company spent such a huge amount and called for new investments within a year.

How is the company faring these days?

Most of the internet and technology companies have seen positive growth in the wake of the Covid-19 pandemic. But Sagoon could not take any benefit from this opportunity. The company submitted its financial report to the government regulator only in July as against the mandated time within April, claiming that the pandemic had made a serious impact on the company’s operation.

Sagoon had 36 full-time staff members in its offices in Virginia in the US, Faridabad in India, and Kathmandu in Nepal, in 2017. Now it has only 16 staff members. This stands in stark contrast with the claims by the founders that Sagoon had been taking great leaps in the market.

Meanwhile, Sagoon submitted an application claiming that it had not been able to pay the salaries of its staff members due to the pandemic. Accordingly, it received a soft loan of $125,000 under the US government’s Paycheck Protection Program as a Covid-affected company. That amount is enough only to pay for the salaries of the company’s staff members for two months.

In view of the recent financial reports of the company and the management’s appraisal of its challenges, the company is on the verge of bankruptcy, said Anil Paudel, a chartered accountant at the Kathmandu-based AP and Associates. “Any investment with Sagoon in this situation is risky,” Paudel said.

Investors becoming helpless

KP Sitaula, who invested in Sagoon from South Korea, is not happy with the company’s latest status. When he was in the leadership of the Non-resident Nepali Association, he also inspired his friends and relatives to invest in the company. But now, he is worried about his investment as the founders were reckless. “They spent more money on showoff than on product innovation and development.”

Most of the investors who came into contact with us seemed to be unaware of how the company has been operating and how it has spent the investments. The company does not provide them with any update. Surya Gurung, the global coordinator of Sagoon, conceded that there have been shortcomings. “Yes, we have not been able to send details to everyone. But we’ve responded to those who ask questions.”

Sagoon investors are not in a position to sell the share to a second market and exit. Sagoon has not been listed in the regular US stock market. The investors had bought its shares according to the Jumpstart Hour Business Startup Act in 2012. Under this Act, there are only two ways in which investors can sell their shares. First, they can find their buyers on their own, do their bargaining, and transfer the investment to the buyers. Second, they can wait until Sagoon ropes in a third party agent for the purchase and sale of the shares.

Sagoon has been speaking about looking for a third party agent since 2018, but its founder, Govinda Giri, said in a recent online press conference that the work will start only from this year.

The founders also seem be worried that when the share is opened for sale in the second market, there might be a transaction at a cheap rate. In such a situation, the founders fear, the reality of the so-called ‘billion-dollar valuation’ will be exposed. Giri seems to be in no mood to go for the second market as long as there is a possibility to raise money through public offering.

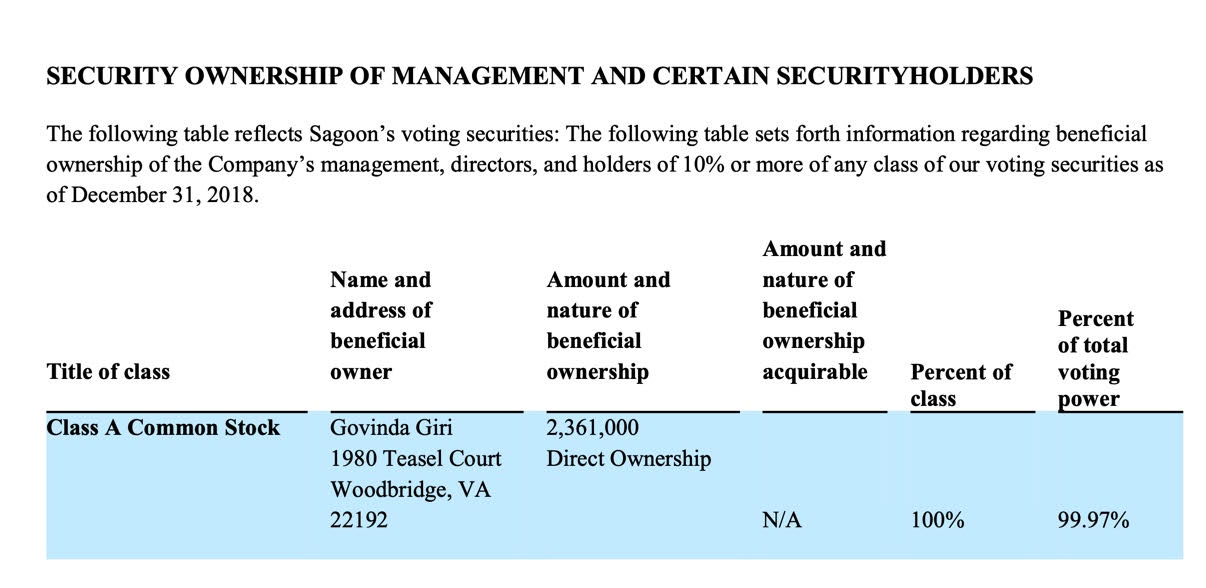

The founder pulls all the strings

The company, which has over 4,000 investors, is run by the one-man policy and management of Giri, the founder. Giri holds a 100 percent share of Class A, the most powerful of the three-tier ownership structure. This amounts to 99.97 percent power over decision making in the company.

A section of Sagoon’s Annual Report 2018.

In Class-C shares released to the public, the shareholders have close to zero decision-making powers. Giri’s monopoly cannot be restricted either by the company’s constitution nor the US law. Giri has been splurging on the public’s money by taking advantage of this power.

As a founder and CEO, Giri also started taking a basic annual salary of $84,000 from March 2018. Apart from that, he is entitled to a bonus and additional allowances.

Similarly, Giri’s colleagues Kabin Sitaula and Swati Dayal also receive salaries from the company. Several documents of engagement and the company’s financial reports contradict each other.

Giri has also made a loot in the name of giving a loan to the company. The 2019 financial report shows that the company took a loan of $66,949 at an interest rate of 24 percent, from a third party, in 2014 and 2015 without a written contract. The interest for this loan was $80,436 by December 2019.

Similarly, the company took $300,000 as a loan from the founder, at an interest rate of 12 percent, and paid interest in 2018. A large chunk of the investment raised from shareholders has gone into repayment of loans at an interest rate of 8 to 24 percent. According to the official ‘Statement of Operations’ of the company, it has paid $137,000 in 2018 and 87,000 in 2019 as loan interest.

The founder has also spent an unusual amount of money on office rent. It paid $89,000 for its Faridabad office rent in 2018. In 2019, it paid only $36,700. Giri himself took $15,000 in 2017 and $12,000 in 2018 as office rent.

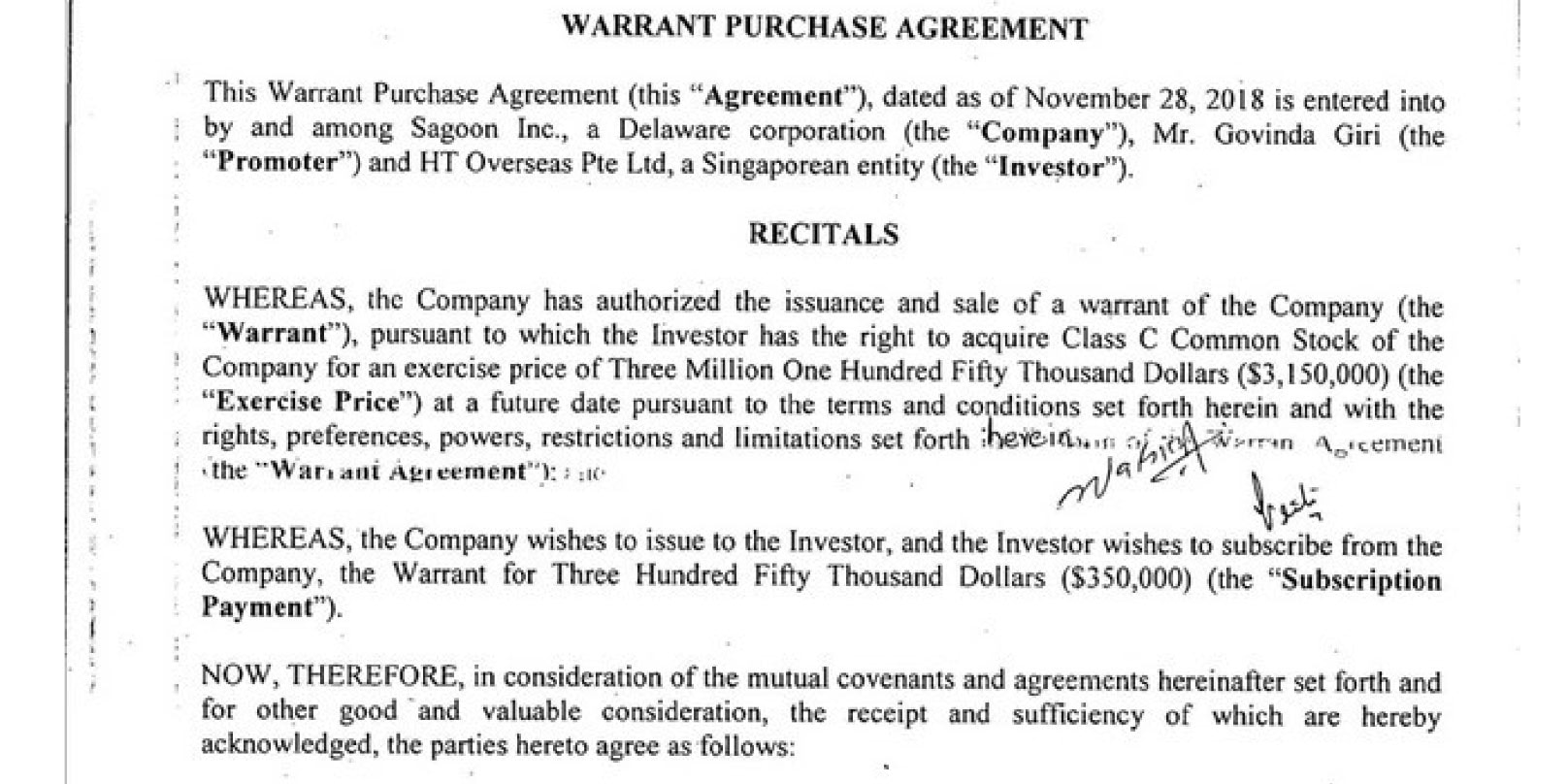

Hindustan Times goes off the radar

In November 2018, Giri signed a strange contract with HT Overseas PTE LTD, a Singapore-based subsidiary company of the Hindustan Times. As per the contract, HT Overseas would buy $5 million worth of shares within five years at the old rate.

This deal was publicised through paid news in India and Nepal. The founder seemed to be of the opinion that they would be able to entice new investors if they could show that their company had investments from a reputed Indian media company.

An agreement done between Diiki Goh, Director of HT Overseas, and Govinda Giri in 2018.

This contract is dubious in itself. As per the contract, HT would invest in Sagoon, but however amount it invested, it would ask Sagoon to return the money to it for advertising and publicity.

With this contract, HT stands to get $5 million worth of shares without any earning for Sagoon. Paudel, the chartered accountant, said, “The fact that one company is getting so many shares without any investment is a betrayal of other investors.”

In 2019, HT Singapore transferred $350,000 to Sagoon for purchasing 15,000 shares. Sagoon returned the money immediately. WIth the returned money, HT did not do any advertisement of Sagoon. Neither did Sagoon release any share. Sagoon’s 2019 annual report mentions HT as having remained ‘out of touch’.

Misuse of NRNA network

Sagoon raised a huge investment by using the network of Non-Resident Nepalis’ Association in 2017 and 2018. Not only did it use the NRNA leadership and its conferences, but it has also brought the association into a controversy.

On July 16. 2018, Sagoon signed a contract to provide a share worth $100,000 to NRNA-Britain. Sagoon raised hundreds of thousands of dollars from Nepalis in Britain through the social credit it earned by supporting the social organisation. But as of now, NRNA-Britain has neither received the share nor the money as promised.

“NRNA-Britain is not allowed by British law to take shares of any private company,” said a former president of NRNA-Britain. “It was just a gimmick by Giri to influence the then leadership and sell shares.”

Surya Gurung, the current global coordinator of Sagoon, is a former president of NRNA-Britain. Conceding that Sagoon has not released the shares as per the contract, Gurung said, “We haven’t been able to do it due to legal complications.”

In 2018, it was advertised that the 4,374 shares worth $100,000 would ve valued at $5 million dollars in two years. See here.

Fake publicity: Self-charging mobile phone

Sagoon Founder Govind Giri on November 17, 2015, organised a grand program in Kathmandu and made a strange announcement. “The mobile app that Sagoon will be launching soon will produce electricity on its own, and mobile phones, once charged, won’t need to be charged ever again.” Giri’s announcement was met by a large cheer from the crowd.

The program was attended by the then Prime Minister of Nepal KP Sharma Oli, who is also the incumbent Prime Minister, along with deputy prime minister Kamal Thapa, other ministers, secretaries and high level social and political leaders. From PM Oli to journalist Rabindra Mishra, everyone present during the program praised the project and linked it to the future of Nepal.

However, those familiar with information technology were dumbfounded by the announcement. “We don’t yet have the technology that conceives of creating energy through software. We can control the energy usage by a device through the use of the software. But there is no way software itself can produce energy. We didn’t want to belittle the work they were doing, but there was no basis for us to support their claim as well,” said engineer Binod Dhakal, the then president of the Computer Association of Nepal.

The aim of the program, organised at a star hotel in Kathmandu, was to raise up to $50 million in investment. Had there been a scientific logic to Giri’s idea of producing energy through software, the idea itself would have been more valuable than the investment Sagoon aimed to raise.

In 2017, DC Nepal Dot Com prepared a video in which Sagoon co-founder Swati Dayal speaks about the idea of charging the battery through software. Sagoon has used the video for its promotional activities.

“People call it impossible, but we’re going to make it possible. Mobile phones that have Sagoon app installed in them won’t need to be recharged ever again after the first charge,” Dayal says in the video.

Professor Dr Manish Pokharel, head of the Department of Computer Sciences and Engineering at Kathmandu University, said the “Mobile Charging Project” had no scientific and technical base whatsoever. “There are technologies that help reduce the usage of energy or get devices charged from a distance. But to claim that software can charge a device is nonsense.”

Professor Dr Subarna Shakya, who teaches at the Institute of Engineering, agrees with Pokharel. “If the software could produce energy as claimed by Sagoon, many big tech companies would have been involved in it years ago.”

For this ‘miraculous invention’, Sagoon had roped in Professor Dr Niladri Chatterjee from the Indian Institute of Technology in New Delhi. When asked what happened to the project that Sagoon had begun with much fanfare, Chatterjee said he had disassociated from the project already. “It failed,” Chatterjee said.

Giri, the founder, also conceded that the project had failed. But he claimed had been shelved due to the lack of funding.

Having used the “Battery Charging Project” to attract the attention of investors, Sagoon never mentioned in its official and legal documents.

Even as the company mentioned the general options in the app including ‘story sharing’, ‘mood talk’, ‘private messaging’ as ‘game-changing projects’ in the Securities and Exchange Commission (SEC), it never mentioned the battery charging project. This makes it pretty clear that the project was nothing more than a gimmick.

A $90 billion company

Sagoon founders evaluate their company’s wealth in such a way that it sounds unusual. The only way to evaluate a company that has not entered the regular stock market is its annual financial report. The company’s last fiscal report shows that it has suffered huge losses. But Giri and other founders continue to make random claims and claim that the company has made great strides.

On 30 June 2016, a news report carried by the online version of Annapurna Post quoted Sagoon’s media and public relations officer that the company’s valuation at the time was $15 million. In March 2017, Giri said in an interview with Khasokhas magazine that the company was valued at $126 million at the time. In the interview, he said the company would be valued at $90 billion by 2023. In May 2018, Setopati.com published a news report saying Sagoon’s valuation was at $95 million, $36 million less than what was claimed in 2017. This year, while seeking investments, Sagoon has claimed that its valuation is at $126 million.

In several places, Sagoon has claimed that its property valuation has increased as per the number of registrations of users on its website and mobile app. However, there is no basis to believe the number of its users. To ascertain whether the users are regular or irregular, AEC on January 6, wrote to Sagoon asking it to clarify the number of unique visitors and average monthly active users.

Stop advertising in Nepal: Securities Board of Nepal

Although there are legal and practical complications in investing from Nepal, Sagoon has spent a huge amount of its money on publicity for investment by organising programs in star hotels, publishing advertisements and inviting celebrities.

The board on July 29 this year released an appeal asking the public not to invest in Sagoon as it had created confusion in Nepal. It said the call for the investment made by Sagoon in Nepal was illegal, and that investors would not receive any legal support. It also asked the media not to give space for information or advertisement about Sagoon on their platforms.

Sagoon, however, claims its advertisements and information are not targeted to Nepal, and that the board has nothing to do with it. “Sagoon even has the backing of the Prime Minister”, Sagoon said as it asked for the board to correct its appeal.

At an online press conference a few weeks ago, Sagoon founder said the board had informally accepted that it had made a mistake. But Niraj Giri, director of the board, told CIJ-Nepal that “The board is clear that Sagoon’s activities are illegal.”

Director Giri, while cautioning non-resident Nepalis about the risks of such an investment, said, “Neither the board nor the Nepali law will be able to protect investors from the risks of such investments.”

Advocate Santosh Sigdel said Nepali law bars companies like Sagoon from publishing advertisements calling for investment. Citing Section 5 of the Advertisement (Regulations) Act, 2076, Sigdel said, “It is illegal to advertise or publicise services that Nepali law has barred from doing inside Nepal. This means that an investment in Sagoon is illegal in itself.”