Affluent businessmen have been reaping the benefits of Nepal government’s agricultural loan subsidy program, aimed to ensure farmers’ access to capital and increase production. An expose on how the government has been funding big businessmen in the name of subsidy, out of taxpayers’ money.

Ramesh Kumar | CIJ, Nepal

The famous businessman Pavan Kumar Golyan is also the chair of NMB Bank. Golyan, who has invested in sectors such as banking, insurance, hotel, hydropower and production industry, has in recent years engaged in agriculture business. His business group produces vegetables in Jhapa’s Madargachhal, Chakchake and Gherabari, subsidized by the government out of state coffers. An investigation by the Centre for Investigative Journalism shows that Golyan, who deals in billions of rupees every year and has created an empire of profitable business, has had the interests for loans taken out in the names of Eastern Agriculture and Brihat Agro Firm donated by the government.

At a time when hundreds of thousands of Nepali farmers are compelled to move abroad for work, after failing to get any help from the government, the government has been paying the interests of loans taken out by businessmen with empires of billion-dollar businesses. So far, at least 7.5 billion rupees have been spent in this kind of donation, funded from taxpayers’ money.

Bhuwan Dahal, chair of Nepal Bankers’ Association and CEO of Sanima Bank, admits that affluent farmers and businessmen have been reaping the benefits of the government’s loan subsidy program. Dahal says that banks are compelled to provide loans to anyone who comes up with valid papers. “Small-scale farmers do not even know that there’s such a program as this,” he says. “Only those who have access to information and resources are being benefited from it. The whole program is a failure.”

The government tends to donate 5 percent interest on loans taken out from banks and financial organizations for agricultural or animal farming. For this kind of loan, the banks cannot charge interest more than 2 percent of the basic rate. Which means that, if the bank’s basic rate is 7 percent, they can only charge at most 9 percent interest. Out of which, the government pays 5 percent interest and the farmers have only to pay about 4 percent. But for small farmers, it is hard to even take out loans, while big businessmen are enjoying the government subsidy. The procedure for the agriculture subsidy program doesn’t have a clearly-delineated criteria on what kind of farmers would be benefited from it, providing leeway to big businessmen to be benefitted out of it.

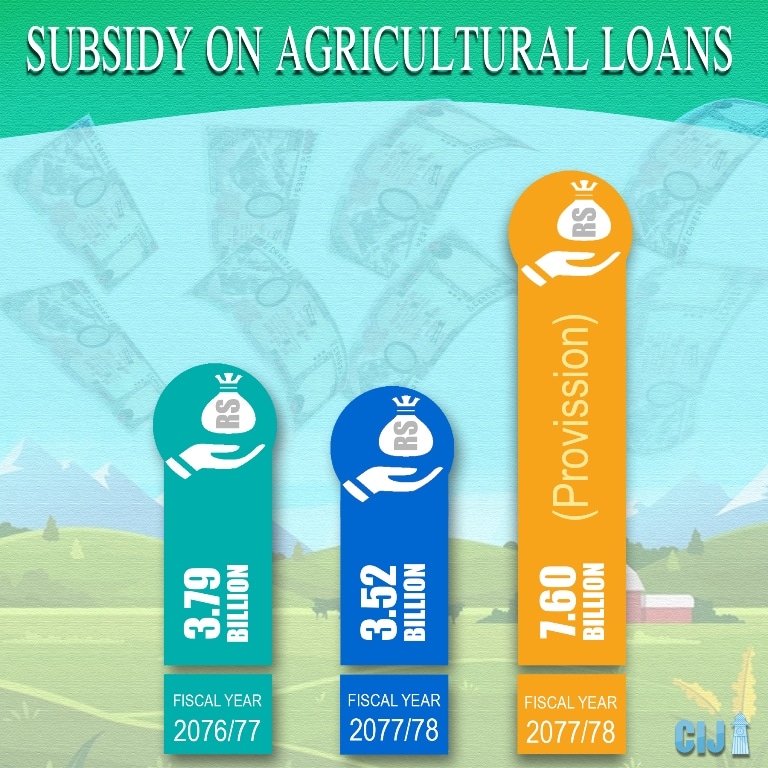

In the first ten months of the last fiscal 2020-21, a total of Rs 3,794,392,000 (three billion 794 million and three hundred 92 thousand rupees) has been spent for the subsidy program. In the preceding fiscal year, the total amount spent was Rs3, 524,864,000. In the budget for the current fiscal year, a total of seven billion and 600 million has been earmarked for agricultural loan subsidy.

But an example illustrates how hard it is for small farmers to take out the subsidized loan. Ganesh Dahal, a local of Chandrapur in Belaka municipality, Udayapur, returned after a decade in foreign employment, and started, with three other friends, an agriculture and animal farm investing Rs12 million. Dahal, who has been looking for subsidized loans for his business, says, “I visited the municipality office and all banks around but I couldn’t find out how I can take out subsidized loans.”

Tax to the people, profit to the rich

A procedure on agricultural subsidy loan program released by the Nepal Rastra Bank (NRB) in March, 2017 had a provision to provide a donation of five percent, up to Rs 70 million, on agricultural loans. The cabinet in 2018 amended the provision and released an integrated procedure, with the provision that five percent donation on interest would be provided for loan up to Rs 50 Million and two percent on loan up to 50million up to 100million.

The program was aimed to inspire youths to engage in agriculture, increase production and provide access to loans for small-scale farmers. “The aim of the program was to inspire returnees from foreign employment and those farmers who didn’t have sufficient capital to inject in their business,” says Rajan Khanal, a former secretary who was at the helm administration of the Finance Ministry at the time the program was announced. “The program didn’t imagine providing benefits to big businessmen.” But the program has had an effect to the contrary.

Statistics obtained from the NRB using right to information proves that the subsidized loan program has been abused by a small number of big businessmen.

According to the statistics, a total of 1353 companies registered to work in the agriculture sector have taken out loans over Rs 10 Million. These companies are established ones, dealing in big transactions. The procedure states that even these companies would receive loans continuously for five years.

On October 10, 2018, the Golyan Group registered Eastern Agriculture Firm Pvt Ltd with a chukta capital of Rs10 million (company registration number: 200854) and Brihat Agro Firm Pvt Ltd (number 200813) at the Company Registrar’s Office under the name of Surabhi Golyan. It is in the interest for loans taken out from these companies that the government started subsidizing from December 2018. Records show that a total of Rs4,039,378 in interest was subsidized for these companies until January 2021.

Pawan Kumar Golyan of the Golyan Group says that he has taken out subsidized loans amounting to about Rs 100 Million from his three companies. As interest, he receives a subsidy of about Rs 5 Million, which doesn’t worth much for him, he claims. “This amount doesn’t matter to me much,” he says. “It only fuels rumors, so I am thinking of returning it back soon.” As a beneficiary of the subsidy himself, he admits that the program has not been able to benefit its target group, that is the small-scale farmers. “Those who formulate these policies should do it in such a way that it benefits small farmers, not big businessmen,” he says.

Saurabh Group, one of Nepal’s biggest business groups, has started receiving interest subsidies from 2077 Kartik for loans taken out in the name of Jagadamba Tea Processing Pvt Ltd. Records show that the Group has received a total of Rs675383 in donations in three months. The group, which deals in rods, cement, banking and real estate, transacts in billions every year. But this very group is taking benefits aimed for farmers. A CIJ investigation has shown that this group is one of the companies to import money from ‘tax haven’ countries.

Another business group Tribeni has also received Rs665970 in donations so far for a loan taken out in the name of Nepal Tea Development Company Limited. The group’s operator Ramchandra Sanghai is the deputy chair of Nepal Chamber of Commerce. After the Nepal Tea Development Corporation was privatized, the Tribeni Group had signed a contract in 2000 to operate the company for 50 years. But the group has not yet paid a rent amount of about Rs 107 Million for the time between 2000 and 2006, according to the 56th report of the Auditor General’s Office.

Balaju Nayabazar-based Valley Cold Store Pvt.

Kedia Organization is known as one of Nepal’s oldest business houses. Sitaram Gokul Mills, which is under the Kedia organization which runs dozens of other businesses, is also listed as the beneficiary of the government’s loan subsidy. The Mills is run by the Kedia family, including Sumit Kedia. The Mills has received a donation of Rs161842 until last January. Records as to how much donation is received after then is not available. Batas Agro Pvt Ltd, under the Batas Group, is also listed as the beneficiary of the loan subsidy since last February.

Govinda Ram Sariya, a Jhapa-based businessman, has invested in multiple businesses including import-export business. His company Modern Tea Industries has acquired a donation of Rs4641000 in loan subsidy. Sariya deals in betel nuts and is a prominent businessman to do so. Last April, the Banijya Department had handed over the import of betel nuts on a quota system.

Another of Jhapa’s big businessmen Pradeep Mittal’s Baibhav Tea Estate and the Tirupati Tea Industries, owned by Om Prakash Agrawal, another businessman from Jhapa, have acquired Rs573000 and Rs407000 respectively in loan subsidies. Agrawal has investments in many businesses including cement industries. Jhapa Tea Estate Pvt Ltd, owned by Chandiraj Dhakal, who is the former chair of Nepal Chamber of Commerce, is also listed as the beneficiary of the loan subsidy program.

Valley Group of Industries is among the biggest dealers of poultry in Nepal. The group, which sells over 10000kgs of chicken a day, has four hatcheries, and three fodder industries under it, and also investments in restaurant, medicine industry, and vehicles importing companies. The group, which is four decades old, has received Rs3.1 million in subsidies under its four companies. Moreover, Valley Pellet Feed and Valley Poultry Pvt Ltd, both companies under the group’s wing, have received Rs947,776 in donations from August 2020 to January 2021. The Mechi Poultry Pvt Ltd and Trishuli Breeding and Research Center, also companies under the group, have received Rs.1,551,000 in donations so far.

Former coordinator of Siddhartha Business Group of Hospitality Dhruba Neupane has established a company called Paicho Pasal, collaborating with, among others, Durga Prasad Bhandari, coordinator of Western Business Group. The company, which deals mainly in agro products, has been receiving interest donations on bank loans since July 2020. Between July and December, the company has received Rs3342527 in interest subsidy.

Officials at NRB say that the loan subsidy program didn’t imagine benefiting businessmen dealing in billions yearly. “No matter how rich one is, they don’t seem to leave alone subsidy from state coffers,” said one official at NRB. “It is necessary that this program, which benefits the rich instead of its target group, is reviewed.”

Keep the collateral, reap the benefits

According to the NRB, by mid-May this year, the number of those taking out subsidized loans stands at 43997; a total of Rs100 billion 96million and 900 thousand has been disbursed as part of agricultural loan subsidy from various banks and finances. Over 98 percent of this loan is provided through collateral deposit. That only about 1.9 percent of total loan is provided through collective collateral and project collateral proves that only those who can keep personal collateral are reaping the benefits of the program.

According to the integrated procedure for donation of interest in subsidized loan 2075, banks and finances can provide loans of up to Rs 1 Million through either collective collateral or project collateral. But not all farmers can develop a project that is trusted by banks, says Nawaraj Basnet, chair of Federation of National Farmer’s Group, Nepal. According to Basnet, only those who can keep collateral can take the benefit of the program. “The government doesn’t have a record of farmers,” he says. “That’s why those who toil hard every day are deprived of the benefits. Those who deal in papers are the ones getting benefitted instead.”

According to NRB’s data, by May 2021, a total of 38176 people have taken out loans keeping collateral through banks or finances, while only 5821 have taken out loans through collective or project collateral. A total of Rs115 billion 410 million loan has been disbursed through personal collateral while only Rs 2 Billion 700million through collective collateral. Those who have taken out loans without personal collateral have received Rs464871 as loans on average while those who can afford to keep collateral have received Rs3023160 on average.

According to CEO Dahal of Sanima Bank, because the process of taking out loans through the subsidy program is like the regular process, banks and finances ask for collateral deposits. For the collaterals to be accepted, the lands should be touched by roads, barring rare exceptions. One can take out a loan amounting about 50 percent to 70 percent of the collateral evaluation.

Deepika Gyawali, who is the finance and marketing chief of Green Growth, a venture that purchases produce from farmers and delivers it straight to consumers, says that because her company couldn’t deposit collateral, they could not get subsidized loans. “Even though banks have announced such subsidized loans, we are not capable of depositing collateral at the moment, and couldn’t expand our business.”

According to the agriculture census of 2011, about 47 percent of the country’s population has land less than 10 ropanis. Because these farmers can’t manage sufficient collateral, they tend to be deprived of the subsidized loan. In turn, they are forced to take loans from rich landlords at exorbitant interest rates.

Bharat Singh Thapa, an assistant professor at Tribhuvan University who has researched about loan in rural settings, says, “In rural areas, farmers are in need of frequent loans but since the banks do not trust them with it, either they have to rely on rich landlords or microfinances, both of which charge exorbitant interest.”

In September 2019, farmers from Malangawa in Sarlahi came to the capital to protest against the exponential interest rates they were subjected to at the hands of a local landlord Shyam Pardeshi. It was exposed that the landlord had exploited about 300 farmers.

Triveni Group’s building and Nepal Tea Development Company Limited’s tea garden.

The ‘Survey of the Nepali People 2018’ report, conducted by organizations including the Asia Foundation and published in 2019, states that out of total loan takers, about one-fourth have had to rely on landlords. Only about 20 percent could take out loans through banks and finances.

Thapa, the assistant professor, says that a majority of farmers make do with loans taken from landlords, neighbors and relatives. The Nepal Lifestyle Survey 2066/67 also states that out of the 65 percent of households who take out loans, only 20 percent did so through banks.

Basnet says that the compulsion for small farmers to take out loans to purchase compost and seeds paying exorbitant interest is intact. Today, the interest rate for loans taken by small farmers is more than that taken by the rich businessmen. Because the banks do not trust the poor, they have had to rely on landlords, cooperatives and microfinances that characteristically charge exorbitant interest rates.

A report published by Himal Khabarpatrika shows how microfinances established to reduce poverty have instead perpetuated exploitation of the poor. Even today, when banks and finances charge 9-10 percent interest rates, microfinances charge over 16 percent.

Perpetuating the monopoly of established businesses

Dozens of companies that have received interest subsidies for loans over Rs 10 Million seem to be related to agriculture trade and processing. This has posed a question on the utility of the whole program.

Dr Yogendra Karki, secretary at the Ministry of Agriculture, says that the subsidy program has not contributed much to production. Moreover, about two-third of companies that have received loans over Rs 10 Million are from seven districts, including Kathmandu and Chitwan. In Kathmandu, where the number of farmers is minimal, 201 people have taken out loans over Rs 10 Million. In Chitwan, 260 companies have taken out such loans. In 22 districts, there is not a single company that has taken out loans over Rs 10 Million.

That businesses from those districts that are already leading in industrial and business sectors are benefitting from the loan subsidy indicates that it is utilized more on business and processing than production. A high-level official from NRB says that there is a likelihood that the businessmen might have taken out loans under the loan subsidy program and invested elsewhere.

On the other hand, even though some businesses related to poultry, dairy and tea production have acquired loans, those businesses were already established ones. This further fuels the suspicion that those businessmen might have transferred their loans under the program even if they took out loans for their ventures earlier.

Chandi Prasad Parajuli, owner of Parajuli Tea Estate and Danfe Tea Processing, companies that have acquired at least Rs1.15million interest subsidy, admits that he benefited from the loan subsidy program by transferring his loan. “Many other tea industries in Jhapa have also been benefited this way,” he told CIJ over a phone conversation.

A research conducted by the regulatory body of NRB in 2020 shows that people have been forging documents to benefit from loan subsidies given under headings such as agriculture loan and women industrial loan. Shishir Kumar Dhungana, secretary of Ministry of Finance, says, “It is found that even those industries run by men have transferred the ownership of companies under women’s names.” He claimed that the ministry is conscious about providing subsidized loans to the target group, and said that research will be conducted to study the efficacy of subsidized loans. The government has been providing up to Rs 1.5million to women wanting to start their business at an interest rate of six percent.

Dr Prakash Kumar Shrestha, chief of NRB’s research department and the economic advisor to former Minister of Finance Bishnu Paudel, said that while it is imperative that measures should be in place to inspire people to get into agriculture, they have not benefited the target group as of yet. “We formulate policies so real farmers get benefitted but only those with power and access have reaped its benefits,” he said. “It is expected that those big businessmen would keep their greed aside.”

There must be a criteria

Among the beneficiaries of the loan subsidy are the big dairies across the country. Kathmandu Dairy, owned by the family of businessman Prakash Maharjan, has received an interest of Rs2743647 donated by the government during the period of 2019 December to 2020 January. Another of Maharjan’s companies, Shakti Foods Pvt Ltd, has received a donation of Rs3877455. Likewise, Nepal Dairy, a four-decade old company, has received a donation of Rs3660831. Another big dairy, Rajdhani Dairy, run by Rajkumar Dahal, has received at least Rs1.3million in donations.

Also in the list are big businesses dealing in poultry in Chitwan. Dr Tilchandra Bhattarai owns about a dozen businesses across fodder production, hatchery and trade, among others. At least four of Bhattarai’s companies benefited from the loan subsidy program. The Pancharatna Feed Pvt Ltd has received Rs610501 in interest subsidy between April 2020 and January 2021.

Poultry Pvt Ltd, under the same group, has also received a donation of Rs618828 while Purbanchal Poultry Pvt Ltd has received Rs853425. Likewise, Pancharatna Hatchery, also under the same group, has received Rs198121.

Another Chitwan-based group Dallakoti deals extensively in chemical fertilizers and pesticides. The Dallakoti Poultry Firm has received a donation of Rs4098244 between 2019 April to January 2021. Chitwan’s Daunne Breeding Firm, owned by Daunne Corporate, has also received a donation of Rs4254421. Daunne Poultry Breeding Firm has received Rs1939134 in subsidy.

The Balaju-based Adhunik Poultry, active since 2050BS, deals in fodder industry, breeding firm and restaurants. This business house has also received Rs4991113 in donations between 2018 December to January 2021. Adhunik Dairy Products has received Rs248048 in donations. The group’s three companies, Adhunik Feed, Adhunik Poultry Breeding and Adhunik Agro Products have received Rs2590000, Rs3823000 and Rs3719000, respectively, in donations.

In the poultry business, too, it is big businessmen who have reaped the benefits of the program. The Balaju-based Quality Hatchery is one of the most established and largest in the country. It has received a donation of Rs2589000 so far. Another of Balaju’s big businessmen Narayan Phuyal’s Phuyal Poultry Feed and Hatchery Industry has received a donation of Rs5227000.

The Adhunik Chicken House, which deals in ready chicken meat and delicacies, has received a donation of Rs4991000. Gourmet Vienna Meat and More Products which sells processed meat has received Rs1041096 in donations. The Pokhara-based Fewa Meat Products Pvt Ltd has received Rs2798247 in donations.

Fewa Group of Poultry has received Rs524667 in donations between November 2020 and January 2021. This group is owned by Moti Prasad Poudel, who is the vice chair of Nepal Chamber of Commerce Gandaki Province. Another Pokhara-based company Bhattarai Poultry Firm has received Rs 4472938 in donations between April 2020 and January 2021. Dr Ashesh Bhattarai of the company has received Rs8388000 in donations for the meat processing industry.

Some profitable microfinances have also received donations out of state coffers. The Banepa-based Mirmire Microfinance has received Rs1883562; NRN Microfinance in Kailali Rs1219178; and Ghodaghodi Microfinance in Kanchanpur has received Rs917809 in donations.

Thapa, the assistant professor at TU, says that it is imperative that the design of the whole program be amended to reach the target group.

“The program should focus on providing donations to poor and niche groups of farmers,” he says. “Those who don’t need the benefits can be cancelled out.”