The deposits embezzled in cooperative scam has reached Rs. 49 billion. But the government and political parties appear indifferent to this scam that took root about 24 years ago.

Sharmila Thakuri | CIJ Nepal

The Ministry of Land Management, Cooperatives and Poverty Alleviation declared the Lalitpur-based Pashupati Saving and Credit Cooperative Limited as crisis-ridden on 17 July 2023.

Namaraj Ghimire, the then registrar of Cooperative Department, had recommended the cooperative be declared crisis-ridden four months earlier, on 13 March, but his recommendation met with logistic hurdles at the ministry.

As the cooperative had been unable to return the people’s savings, depositors filed complaints and intensified pressure. After that, the cooperative’s chair, Chandra Bahadur (CB) Lama, used his political clout to avoid detention. Lama was a candidate for provincial assembly from Kavre (a) in 2017 and 2023, with a Nepali Congress ticket.

Lama then got into another trouble. He was accused of fraud once again, through the Kantipur Saving and Credit Co-operative Limited, which he had established. Following the complaints, the Central Investigation Bureau of Nepal Police has issued an arrest warrant for him. Lama is currently on the run.

Victims of Kantipur Cooperative at the police station to file a complaint. In the bottom right corner, the chairperson of the cooperative, Himalaya Bikram Malla Thakuri. Pics: Suman Nepali/Himalkhabar

Many other cooperatives have reached the department asking it to declare them crisis-ridden.

According to Advocate Ramchandra Simkhada, who is knowledgeable about the cooperative sector, because the Crisis-ridden Cooperatives Management Committee takes the responsibility of such cooperatives, managers reach the department asking it to declare their cooperatives crisis-ridden.

“After the committee says it’s looking at those cooperatives, the police refrain from arresting the managers,” he said. “Because the current and fixed assets of those institutions are locked, they are to an extent safe as well.”

Meanwhile, as the committee performs its work at a slow pace, the cooperative operators get time to “manage” their assets before the committee finds out about it.

The department’s spokesperson Tolaraj Upadhyay, however, says that cooperatives are not declared crisis-ridden just because somebody demands it. Only when the department finds upon inspection that the cooperative is genuinely facing problems does it recommend to the ministry that the institution be declared crisis-ridden.

“While some come at us asking the cooperative be declared crisis-ridden, others move the court against our decision to declare them crisis-ridden,” Upadhyay says.

Disturbed cooperatives

Some cooperatives that had presented working plans to resolve the problems have moved the court after they were declared crisis-ridden. One among those is Shree Laligurans Multipurpose Cooperative Organisation.

“We had presented a working plan at the department for the resolution of problems at our cooperative,” chief executive officer Surendra Bhandari says. “But the government forcefully declared us crisis-ridden. That’s why we moved the court.”

Rajendra Prasad Pandey, Banshidhar Mishra, Pampha Bushal and Anamika Nidhi.

Prior to this, the cooperative had issued a public notice asking debtors to pay back their loans. Among those who didn’t repay loans included CPN (Unified Socialist) leader Rajendra Pandey, former Nepali ambassador to Bangladesh Banshidhar Mishra, Maoist Centre leader Pampha Bhusal, and Anamika Nidhi, wife of Nepali Congress leader Bimalendra Nidhi.

One of the cooperative’s office bearers alleges that alarmed by the notice, these high-profile individuals quickly had the department declare it crisis-ridden.

While the cooperative was open until three days after the government’s declaration, police and officials of the Crisis-ridden Cooperatives Management Committee went to its office and ordered it shut down.

Paudel, the spokesman of the committee, however, says that since court procedures take a long time, some cooperatives move the court to utilise that time and settle their accounts. But the committee doesn’t seem to be doing its work effectively.

The public notice issued by Laligurans Cooperative.

According to Article 106 of the Cooperatives Act, the committee can organise the crisis-ridden cooperatives’ general meeting and use all rights granted to the account supervision committee.

Not only that, according to the Act, the committee can also seize the current and fixed assets of operators of such cooperatives, their staff and family members.

400 die without getting their deposits back

In a first, the Nepal government had declared Oriental Cooperative crisis-ridden on 6 November 2017. But over six years on, the depositors haven’t still got their deposits back from the cooperative.

Dayasagar Kafle, a resident of New Baneshwar in Kathmandu, had deposited as much as Rs 1.5 million amount that he received after selling his ancestral property at the cooperative on 19 January 2012. At the time, the Rastriya Banijya Bank provided a maximum interest of 2 percent at one’s deposit, other banks provided up to 6 percent, and Oriental provided a whopping 18 percent interest. Kafle was tempted.

The tenure of his fixed deposit completed on 17 January 2013. But Kafle and thousands of others didn’t get their deposits back. Kafle passed away two years later without receiving his money back. Kafle’s sons now routinely visit the office of crisis-ridden cooperatives management committee hoping to get the money back.

Khagendranath Kafle, another resident from Baneshwar, had also deposited as much as Rs 3 million amount at the Oriental cooperative but he too hasn’t gotten his money back yet.

According to Kafle, as many as 400 who had deposited their money at Oriental have died without getting their deposits back. Kafle is also an activist involved with Oriental Cooperative Victims’ Struggle Committee. Seconding Kafle, another victim, Dr Narayan Gajurel, says, “We haven’t kept an exact count but many victims have already passed away. Still, there are as many as 4,259 of us claimants.”

Some time ago, when Yubaraj Subedi (ex-judge at the High Court) was the chair of the committee, it had returned the amounts of depositors who had less than Rs 10,000 deposit by selling the cooperative’s land. But the committee’s tenure expired on April 5.

After the cooperatives are declared crisis-ridden, it seems debtors have had a hard time paying back their loans. Padam Raj Pandey, a local of the erstwhile Chapali Bhadrakali VDC-2, is one of them; he has been visiting the committee’s Anamnagar office to release his collateral after paying back loan.

Pandey had taken out a loan of Rs 24.7 million from Kantipur Saving and Credit Limited on 24 November 2011 keeping his 2.5 storey house as collateral. After he missed his EMI for a long time, the cooperative issued a public notice to auction his property. Pandey then reached the court, which passed the verdict that the house should be released after Pandey pays Rs 49 million to the cooperative. By then, the cooperative had been declared crisis-ridden, and Pandey reached the committee’s office with the court verdict.

But the committee refused to release Pandey’s house as per the court order. The committee said that Pandey had to pay as much as Rs 80 million to have his collateral released.

According to then chair of the committee, Kashiraj Dahal, even if the court had put the amount at Rs 49 million, records from Kantipur Cooperative showed that Pandey’s principal and interest amount had reached Rs 80 million, hence taking a decision on the matter had been difficult.

“How can the collateral be released without paying all of the principal and interest when the cooperative itself has been saying that it’d keep the collateral?” Dahal says. Moreover, since Pandey has moved the Supreme Court against verdicts of district and high courts, no more decision would be taken on the matter until the top court verdict, Dahal adds.

But Pandey says that if the committee returns the collateral as per high court order, he’d retract the case at the Supreme Court. “The committee and Kantipur Cooperative are partnering to gobble up my house,” he says.

The committee’s member-secretary and spokesperson Keshav Prasad Paudel, however, has a different opinion on this. According to him, the committee has the right to resolve the issue by determining an amount that is either double the principal or includes 15 percent interest; the committee can determine the amount that is higher as one that Pandey has to pay. “I don’t know why the committee has been indecisive in Pandeyji’s case,” he says.

Meanwhile, the land of Kathmandu Bishwa Joshi that was kept as collateral was also released only after a year since he repaid the loan.

The Crisis-ridden Cooperatives Management Committee was formed on 13 January 2018 as per Article 104 of Cooperatives Act 2074 BS. So far, the government has declared 20 cooperatives as crisis-ridden.

In implementing federalism, the government in 2075 BS had dissolved division cooperative offices in 38 districts and presented the records of cooperatives to local and provincial governments.

Now, cooperatives that operate in only one local unit come under the respective local unit, those with more than one local unit come under provincial government, and cooperatives operating inter-provincially come under the federal government.

But local units and provinces do not have the resources and structure to monitor and regulate cooperatives under their jurisdiction.

The Cooperatives Department, which is tasked with monitoring, regulating and overseeing the cooperatives, says it has to look after only 125 cooperatives. It doesn’t have skilled manpower for the task either.

A problem spanning 24 years

The trend of cooperatives getting closed with their operators fleeing without paying depositors’ money started in 2000. At that time, about 150 cooperatives in Kathmandu Valley alone had embezzled depositors’ money. But neither the cooperatives department nor the National Cooperatives Federation has kept a record of it.

“At that time, it was estimated 150 cooperatives had embezzled depositors’ money.”

Omdevi Malla, chair of the federation, says, “At that time, it was estimated 150 cooperatives had embezzled depositors’ money.”

Trilochan Pangeni, former acting director of Nepal Rastra Bank, seconds Malla, and adds that the central bank had prepared a draft for amending the Cooperatives Act 2048 BS after that.

The committee formed under Pangeni’s leadership had come up with measures such as forming an independent body to monitor, regulate and direct cooperatives, mandatory provision for saving and credit cooperatives to be affiliated with Loan Information Centre and set a ceiling of amount people could deposit in the cooperatives.

“I went to the US for study after formulating the draft of the Act but once I returned, the draft was nowhere to be found,” Pangeni says. “Some cooperative activists got angry because of that draft.”

Officials including former chair of National Cooperatives Federation, Keshav Prasad Badal, another former chair Deepak Prasad Baskota and chair of National Cooperatives Bank, KB Upreti were dissatisfied with the draft.

Uprety says that restricting the draft to become an Act was a mistake. “I didn’t know then that such a day would come,” he says. “At that time, I thought the Act would be detrimental to cooperatives. But now I know!”

After that, the government kept forming committees and commissions to solve cooperative problems but the recommendations of those bodies were never implemented.

After problems began to be seen in cooperatives, the Cabinet in its 28 July 2004 decision formed a 11-member study committee under the leadership of then member of National Planning Commission Dr. Yubaraj Khatiwada. The committee was aimed at studying the proper legal and structural measures for the smooth functioning of cooperatives.

The committee presented recommendations such as forming a new body to regulate, monitor and oversee cooperatives and other financial organisations, and until that is done, the Nepal Rastra Bank would oversee, regulate and monitor the National Cooperatives Bank.

Likewise, the committee had also recommended amending the Cooperatives Act, fixing a ceiling on loans, and training staff at cooperatives department and deploying them to monitor cooperatives.

The committee’s recommendation also included setting a criteria for cooperative members’ qualifications, setting code of conduct for operators, and provision to bar multi-purpose cooperatives from conducting deposit and loan transactions.

But political parties leading the government didn’t take any move to implement the recommendations.

Likewise, the government in October 2004 formed a two-member committee to study the necessary legal structure and institutional provisions for operation of National Cooperative Bank and saving and credit cooperatives. The committee included cooperatives expert Tulasi Prasad Uprety and legal expert Surya Ratna Shakya.

This committee repeated many of the recommendations made by the committee headed by Dr Khatiwada. While the government shelved the recommendations, it, however, kept on forming other such committees.

The Cabinet meeting of 21 August 2012 formed a five-member committee under the leadership of then under-secretary at Finance Ministry Baikuntha Aryal that aimed to relay suggestions on monitoring institutions conducting savings and credit transactions.

That committee too presented a report with suggestions such as restructuring and enhancing the capacity of cooperatives department, immediately monitoring cooperatives organisations, fixing interest charged by cooperatives, setting a ceiling of deposits, barring advertisements, and making membership at relevant associations compulsory for institutions.

Likewise, the government on 25 January 2013 formed a third such committee, under the leadership of then deputy governor Mahaprasad Adhikari. This committee suggested the frozen assets of crisis-ridden cooperatives, their operators and office bearers be gradually released to collect loan amounts.

Moreover, the committee also suggested a ceiling be determined for personal deposits and a provision be introduced so cooperatives couldn’t collect more deposits than their total capital; punish the cooperatives’ officials embezzling funds; and connect cooperatives to Loan Information Centre, among others.

The committee also recommended conducting a special auditing of cooperatives that record transactions of over Rs 500 million, and include the chief operating officer and members of the auditing committee from different families.

The government kept on forming new committees and ignoring the recommendations of previous committees.

In Baisakh of 2070 BS, the government formed a probe commission under the leadership of Gauri Bahadur Karki that aimed to investigate crisis-ridden cooperatives.

The commission recommended issuing an ordinance on new Cooperatives Act and Tribunal. As per the recommendation, the then Sushil Koirala government did issue an ordinance but after that government fell, the ordinance couldn’t become a law.

The government shelved the report of that commission too. Meanwhile, on Baisakh 16, 2080 BS, the government formed a 13-member task force under the leadership of Dr. Jaya Kanta Raut that aimed to provide suggestions on improving the cooperatives sector.

That task force recommended establishing a loan security fund, making it mandatory for all cooperatives to issue a white paper, establishing a loan collection tribunal, and having Nepal Rastra Bank monitoring and regulating cooperatives with over Rs. 500 million of transactions.

The task force also recommended forming a ‘cooperatives monitoring and overseeing board’.

The embezzled Rs 49 billion

According to records from the Cooperatives Department, the Crisis-ridden Cooperatives Management Committee and cooperatives concerned, as much as Rs. 48 billion 940 million amount doesn’t seem likely to be returned to depositors soon.

According to records from the Cooperatives Department, the Crisis-ridden Cooperatives Management Committee and cooperatives concerned, as much as Rs. 48 billion 940 million amount doesn’t seem likely to be returned to depositors soon.

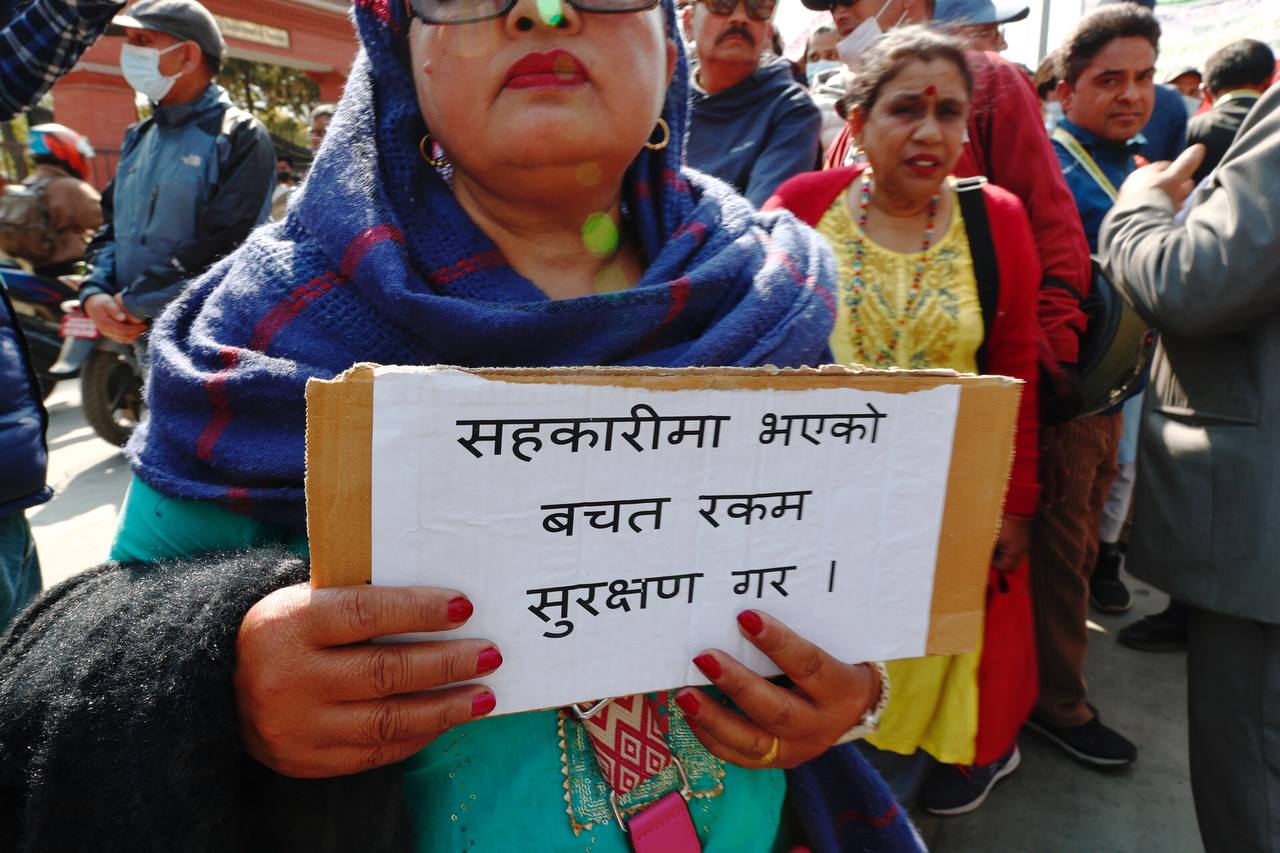

Even while people’s hard-earned money is being embezzled, the government and the parliament haven’t done anything significant to resolve the problem. The parliament’s recent session concluded without discussing the problem amply.

The parliament session, which was frequently obstructed amid a tussle between Home Minister Rabi Lamichhane and opposition Nepali Congress, was ended abruptly by the government.

Lamichhane has been accused of taking illicit loans from cooperatives while he was the managing director of Galaxy Television, owned by Gorkha Media Network. Regarding this, the Congress has been demanding a formation of a parliamentary probe committee.

But amid this tussle, no discussions were held on how to return depositors’ money and punish the guilty. Even though numerous committees and commissions have recommended improving existing laws, no work was done towards that. The general depositors didn’t come into priority.

After ending the parliament session, the government has decided to formulate law to resolve the cooperative victims’ problems.

A Cabinet meeting on April 25 decided to formulate law through fast-track since no resolution to the cooperative problem was possible from the existing laws, according to Communication Minister Rekha Sharma. It remains to be seen whether such a law could resolve the problem and return the depositors’ money.