In Nepal’s remote outback, the rich loan-sharks force poor farmers and aspiring migrant workers to sign promisory notes, agreeing to pay four times higher than the borrowed money at steep interest rates. This feudal practice, abolished by law is not only thriving, but is recognized by local court.

EKAL SILWAL- Centre for Investigative Journalism

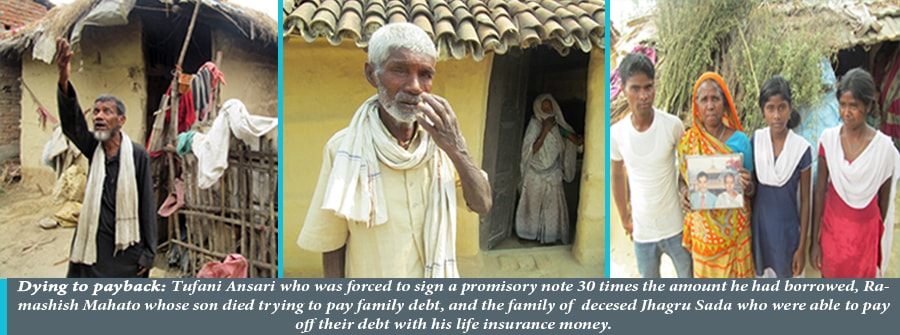

Seven years ago Tufani Ansari of Sarpallo-8 Mahottari borrowed 10,000 rupees from his neighbor Sonelal Mahato at the interest rate of 36 per cent per annum. Last year, Sonelal updated the loan papers which showed accumulated amount of 320,000 rupees in principle and interest put together. Borrower Tufani had Rs 100,000 with him which he offered to pay, but Sonelal was unwilling to discount a penny less. Dejected, Tufani, 66, now lives in fear of being dragged to the court by his neighbor.

Tufani has a reason to fear. Last year, his fellow villager Aghanu Mandal, who had borrowed 205,000 rupees from a neighbor, was dragged to court which ruled against him. Mandal was thrown out of his land and property, worth several times the amount he had borrowed.

Ironically, Tufani who is reeling under the debt burden is a former ward chairman and local leader of CPN-UML, a party which claims to be vanguard of the poor. Yet, Tufani expresses his helplessness, ‘It doesn’t matter who you are, which party you belong to. We cannot change things here, so we are cursed to live with it.’

In 2003, Satyanarayan Yadav of Sarpallo 9, Pachiyari borrowed 13,000 rupees from a local trader Ganga Mahato at the interest rate of 36 per cent. Yadav agreed to pay back his debt by working in Mahato’s farm. After five years of grueling labour in the farm, Yadav fell ill. Yadav had no money for his treatment and Mahato refused to pay for him saying, the man still owed him money. Although villagers managed to raise some money in pittance, Yadav died on the way to Janakpur Hospital.

Even after several years of labouring, Mahato reckons Yadav is yet to pay back his money in principle and interest and has transferred the burden of the debt to Yadav’s wife and four young children.

Ganga Mahato waved the ‘ Kapali Tamasuk ’, a promisry note signed by Yadav and told us, ‘He died without paying me back. So, his famiy must pay me back now.The amount exceeds 100,000 rupees in principle and interest, but I am willing to settle for whatever community members decide.’

Subalal Yadav of Balwa-5 had a comfortable life, a spacious house and a decent earning until he decided to borrow money from local traders to buy a piece of farm land ten years ago. As the interest on the money he had borrowed added up, he was forced to migrate and work in Qatar for eight years. But that did not save him from losing his property.

The loan-sharks from whom he had borrowed money took him to court. While the case was still pending in the court, one of the lenders Ram Ishwor Yadav, who has lent Subalal 80,000 rupees, forced him to transfer the land in his name. Yadav also recovered 500,000 rupees in interest from Subalal. Subalal also paid over a million rupees to Raas Bihari Chaudhary, from whom he had borrowed 400,000 rupees. Last year, he sold off his house to settle the remaining debt.

Subalal now lives in a shack, far away from the main road where he once lived comfortably. He had taken a loan to buy a farm land, and wanted to work hard to educate his children. ‘There is nothing to look forward to in life anymore, except grief.’ laments Sublal.

Six years ago Ramashish Mahato of Banaut-9 took a loan of 80,000 rupees from Mujabir Baitha to send his son-in-law Bhola Mahato abroad. In order to secure the loan, Mahato agreed to mortgage a section of his land in his creditor’s name. But Mujabir deceived Mahato and got the entire plot of land registered in his name.

When his son-in-law did not pay the loan back, he took another loan to send his son Joginder to Qatar, to help him pay off the debt. After toiling for three years in Qatar, Joginder was barely able to pay back the money family his father borrowed to send him to Qatar. Unable to pay his father’s debt, dejected Joginder suffered a massive heart attack on the sixth day of his return and died. Ramasish’s elder son Bunilal deserted him, while Joginder’s wife went back to her parents. Now, old Ramashish and his wife (pictured) are left to fend for themselves.

Thakan Ram of Balwa-5 has also borrowed money from six people. Five years ago, he borrowed 60,000 rupees from local trader Rajesh Yadav to send his son Laxman to Malaysia, which he subsequently paid back. But, Thakan alleges Yadav has forged the promisory note which states he may have to pay 300,000 rupees in principle and interest.

His son was sent back from Malaysia due to health reasons. And since then Thakan has taken more loans to send his son to Saudi Arabia and Qatar in search of better work and pay. Each time Laxman was forced to return, unable to work due to his failing health.

Now, Thakan Ram lives with his family in a small shack with no income and an accumulated debt of over a million rupees. ‘I will pass my debt on to my two sons and die, and if they can’t pay it in their lifetime, they will do the same.’, says Thakan with tears in his eyes.

Last November, 30 year old Ramsnehi Mandal of Sahasaula-3, Mahottari had borrowed 130,000 rupees from his neighbor Shivaji Khatwe at an interest rate of 36 per cent, to go to Saudi Arabia. Mandal wanted to earn some money to settle his family’s old debt. Unable to find a good job or to send back money, Mandal died after five months.

It is a cruel irony, the money Ramsnehi could not pay back while he was alive, was paid to his family over his dead body. The government paid 700,000 rupees to Ramsnehi’s family, as a relief and life insurance money, of which 620,000 was used to pay back nine people whom the family owned.

He may have redeemed his family, but Ramsnehi’s parents are in shock after losing their young son, and his pregnant wife Ganga is inconsolable. His one year old daughter Aanchal (pictured) probably does not know yet, why her father died.

Mahottari’s Jhagru Sada’s story is no different from Ramsnehi’s. He borrowed 150,000 rupees from local traders to go to Saudi Arabia but succumbed to the scorching heat of the desert after ten months. His wife Kushma Devi took another 60,000 rupees loan to bring his body back from Saudi Arabia, after which she then received 500,000 rupees relief and insurance money. The money was spent paying back the lenders and for her husband’s final rites.

Jhagru had gone to Saudi Arabia with a dream of a better future for his family. Now, his wife Kushma is working as a daily wage labourer, to barely feed her four children.

Deceiving numbers

In many districts across Nepal’s southern plains, poor and needy families are forced to borrow money at steep interest from village loan-sharks to manage household expenses and larger occasions like weddings, or to go abroad. The lenders make them sign promisory notes with interest rates much higher than those charged by financial institutions, forcing the family to pay back four times more than what they had borrowed.This is then used as a weapon to threaten poor families who borrow money and to take away their mortgaged property.

Although, many remote districts now have some kind of rural banking facilities, only the middle class and affluent families have access to easy finance and loan services from banks and financial institutions. As a result, poor families like that of Satyanarayan Yadav of Sarpallo-9 fall easy prey to local loan-sharks and are forced to sign promisary note four times worth the amount borrowed with 36 per cent interest rate.

‘When we borrow 100,000 rupees, the lender forces us to sign a promisory note inflating the number four times, and when 36 per cent interest is added to it, that sum increases by several hundred thousand rupees by the time it is paid off. We who ask for money know nothing about how the calculations work, because this is how things have been for decades and we can do nothing about it. And when we are unable to pay off the debt, we lose our land and property.’ , explained Umesh Kumar Mahato, local leader of Samajwadi Forum Nepal in Sarpallo village of Mahottari.

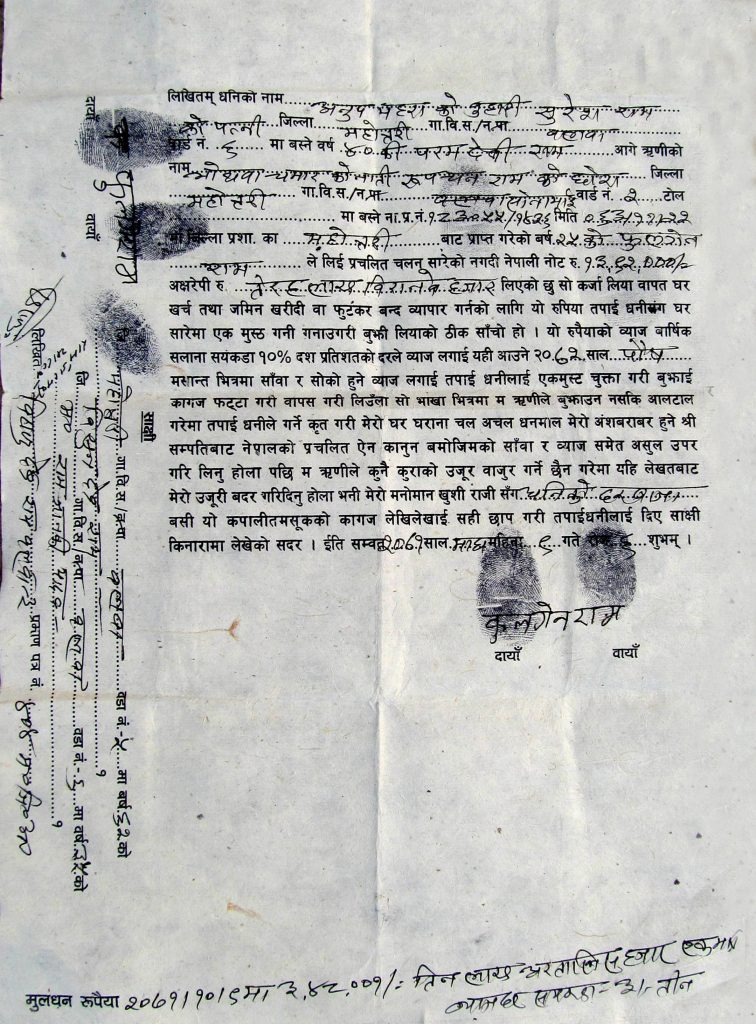

Paramdevi Ram of Balwa-6, Ramtol had lent 100,000 rupees to her neighour Fulgen Ram, who wanted to go abroad for foreign employment. But, the recruiting agent disappeared with the money, leaving Fulgen in the lurch. Fulgen could neither leave, nor return Paramdevi’s money, who meanwhile has already paid 560,000 rupees to the lender. As per her promissory note, she still needs to pay back 440,000 rupees. Unable to escape from the tight spot, two years ago Paramdevi asked Fulgen to sign another promisory note with her, agreeing to pay 1,392,000 rupees, at 10 per cent per annum. (See: Promisory note)

Now, both Paramdevi and Fulgen are caught in a vicious cycle of debt, which is increasing at astronomical rate. Unfortunately such promisory notes are still recognized by Nepal’s courts, which encourage local rich and powerful to exploit poor families.

In 2003, Manbir Darji of Nawalparasi mortgaged his father’s land to secure a loan of 85,000 rupees from local agent Dasrath Giri, who promised him a job in Qatar. The deal was that Giri would return the land after Darji paid him the money with interest. But, after Manbir’s father Lakshman transferred the land in the name of Giri’s wife, the Giris left the village without any notice.

The betrayal shattered Manbir’s family. Unable to bear the loss, Lakshman Darji committed suicide. Manbir has been toiling in India for better job opportinuties, while his older brother Bhakta Bahadur has been on the lookout for Dasrath Giri for more than 10 years now.

Tracing the rot

According to advocate Kosh Raj Kafle, the incumbent laws on credit and interest rates prohibit individual lenders from charging interest rates of more than 10 per cent. ‘The law explicitely provides that the amount paid in interest by the loanee must not exceed the principle amount. So, the promisary notes that force people to pay four times the principle amount with 36 per cent interest rate is illegal. This exploitation must stop.’, says Kafle.

The village loan-sharks force poor locals sign promisory notes that are four times worth the amount borrowed.

According to Nepal’s Central Bank report, there are 48 banks and financial institutions and 674 micro-credit cooperatives, whose collective transactions exceed 480 million rupees. Despite such a thriving financial market, these institutions have not been able to cater to the poor and needy. Instead, it is the rich and powerful who secure loans at low interest rates from the banks and then lend it back to the poor at steep interest rates.

Our investigation also revealed, the viscious cycle of deceit and exploitation begins with foreign employment agencies in Kathmandu mobilizing brokers to trace unsuspecting villagers with weak economic background, luring them with prospects of well-paying jobs abroad. Since most of these aspiring men in villages across Madhes come from poor families, these agents take advantage of their situation. After brokering loan deals from rich families in the village at high interest rates, the agents and their brokers start to fleece commission money from aspiring migrant workers in the name of processing work permit and travel documents like passport and visa , pushing them further in visicious cycle of debt.

Even if the worker is lucky and the lined up job is good, he will spend most of his earning settling the huge burden of debt. But, in many cases, they return empty handed like Thakan Ram’s son Laxman, or in coffin like Jhagru Sada and Ramsnehi Mandal, leaving the family to settle the debt. And it is in such situation, the mighty and rich who lend money start threatening the poor borrowers, evicting them from their land and property to settle the lopsided deals.

People who write such promisory notes to seal the deal between lenders and borrowers make around 100- 300 rupees per note. Thousands of unemployed youths in villages and towns across the country are aspiring to go abroad to pay back family loan. There is a high demand for those drafting these notes, and now they have a template where they simply put in the information of lenders and borrowers. Its a thriving business!

The influence of the handful of rich lenders of the village extends to legal corridors of power. The cases of financial dealings based on promisory notes make up almost a third of all cases in Mahottari’s district court.

In the fiscal year 2014/15, of the 3531 cases filed in the district court, 941 were related to such transactions.Surprisingly, in most cases, district courts have given validity to such shoddy transactions. This has encouraged the illegal business that runs on deceit and exploitation of the poor.

Bhoj Kumar Basnet, the registrar at Mahottari District Court says, ‘Nepal’s legal system is turning a blind eye to grave injustice, by validating a document that has been legally crafted to cheat the poor.’