As the government fails to control the atrocities of loan sharks, unsuspecting borrowers in Kailali continue to lose their properties for petty loans.

Chandani Acharya | CIJ, Nepal

When Hari Prasad Chaudhary wanted to buy a tractor and repay his bank loans, he approached Ramesh Ghimire, a local real-estate trader. Ghimire promised to provide Rs2 million in loan to Hari Prasad, but the latter would have to transfer his land to the former as surety. Hari Prasad, a resident of Nakfoduwa village in Ghodaghodi Municipality in Kailali district, transferred 1 bigha and 15 kattha of land to Ghimire on 24 Kartik 2072. As per the understanding, Ghimire would return the land upon clearance of the loan within five years.

Ghimire, however, sold the land to someone else four months later, in Falgun the same year. “He sold the land he had taken from me for five years within four months,” said Hari Prasad.

As per the Land Revenue Office record, Ghimire sold the land to Manish Sharma and Kuldeep Sharma at Rs9.6 million. (See land transfer deed).

The same year that they had bought it, Manish and Kuldeep kept the land as a surety for Rs8 million in loan at the Surkhet branch of NCC Bank. And when they failed to pay the loan and the interest, the bank attached the land in its name.

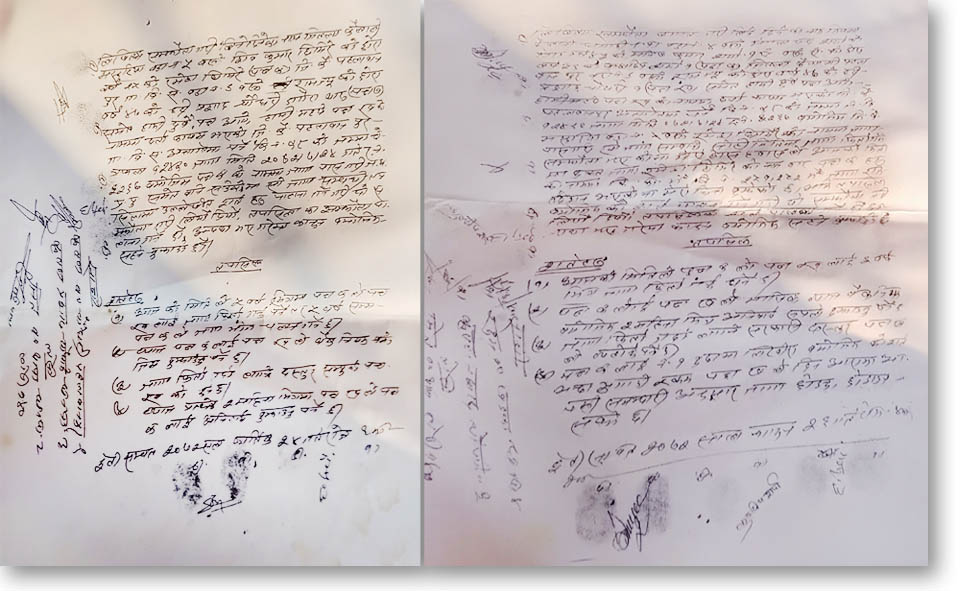

A loan deed signed between Hari Prasad Chaudhary and Ramesh Ghimire on November 10, 2015.

“The bank has attached the land as no one came to repay the land and claim the property after multiple notices, said Bishnu Kandel, staff at the bank’s loan department.

As per the municipality’s assessment, the price of the land, which lies along the Pahalmanpur-Lalbojhi road, is Rs6 lakh per kattha. As per Hari Prasad, the market price of the land is Rs9 lakh per kattha. Even in terms of governmental assessment, the price of the land, which Hari Prasad lost after taking an Rs2 million loan, stands at Rs 21.6 million.

After losing his land to loan sharks, Hari Prasad now has only his home and compound in the land of wealth.

Many farmers from Kota, Tappa, Nakfoduwa, and Banbarsha villages in Kailali district’s Ghodaghodi Municipality-12 have finished their wealth after falling into a personal debt trap. What is worth noting is that most of the loan sharks are familiar with, or relatives of, the borrowers.

A bigha of land for Rs3 lakh

Hari Prasad is not the only person duped by loan sharks in Nakfoduwa. Eight others have lost their pricey land for almost nothing.

When Ram Lal Chaudhary needed money to fund his children’s education, he took a loan from MC Rana, a resident of Dhangadhi, in Jestha 2072. Ram Lal took a loan of Rs3 lakh after transferring a bigha and five kattha of land to Rana on the condition that Rana would return the land upon repayment of the loan.

However, he has yet to get his land back six years later. “My son has started earning now, and I can repay the loan. But the lender is just delaying the transfer,” Ram Lal said, adding, “I’ve been paying the interest, and I don’t know when I will get my land back.”

Ram Lal said he had paid more than one lakh rupees as interest as of now, but he has not kept a written record of the same.

The market price of his land is Rs160,000 per Kattha now. He regrets taking a loan of Rs3 lakh against a piece of land whose price is Rs4 million. What’s more, he doesn’t even know where he could complain to get his land back.

“Who will listen to people like me anyway? I don’t have much legal entitlement now,” Ram Lal said.

Loan brings discord in family

When Krishna Chaudhary and his younger brother Kanhaiya planned to open a school, they needed a loan. Kanhaiya took a loan of Rs1 million, in 2063 BS, from the Sukhad branch of Agriculture Development Bank but could not pay the instalment amount. Ten years later, the bank sent them a notice that it was going to auction their land, for they had to pay a total of Rs1.5 million including loan and interest amount.

Krishna, the elder of the six brothers, discussed with his brothers and transferred 2 bighas and six kattha of land belonging to their mother to lender Chandra Prakash Chaulagain on 23 Asar 2073. They took Rs2.8 million rupees from Chaulagain at an interest rate of 36 percent a year and cleared the loan at the bank. (see loan deed).

The loan amount solved the problem for the time being, but the family became entangled in a more significant problem when the lender did not return them the land.

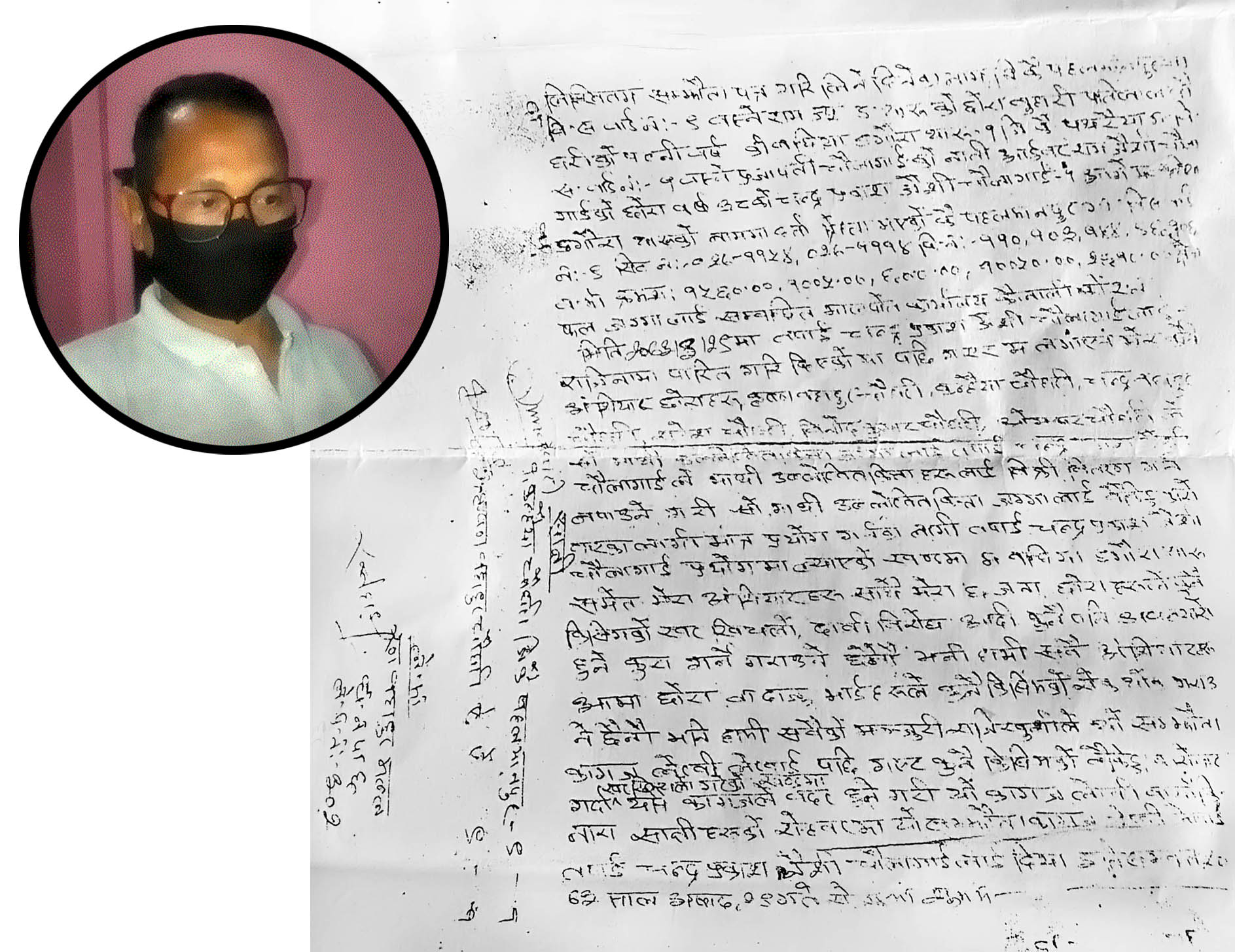

A deed signed between Krishna Chaudhary and Chandra Prakash Chaulagain after land transfer on July 13, 2016. [Inset: Krishna Chaudhary]

According to Krishna, the lender asked him to pay Rs2.86 million, failing which he would sell the land to someone else. “I asked him not to sell it to anyone else, but he ended up selling it at Rs160,000 per kattha,” said Krishna.

Today, Krishna and his brothers have become landless. Apart from the land, the brothers have lost Rs2.13 million that they had paid as interest. And since Chaulagain had taken the land legally, Krishna said, there was no way they could take him to court.

Chaulagain, on his part, said he had just helped Krishna when he was in trouble. “I helped him save his land that the bank was auctioning. Everything was clear in the beginning. They have duped me by not paying my money,” said Chaulagain.

Chaulagain added that he had received only Rs6 lakh as interest and that he had warned the brothers that he would sell the land if they did not repay the loan.

Petrol pump becomes a thorn in the flesh

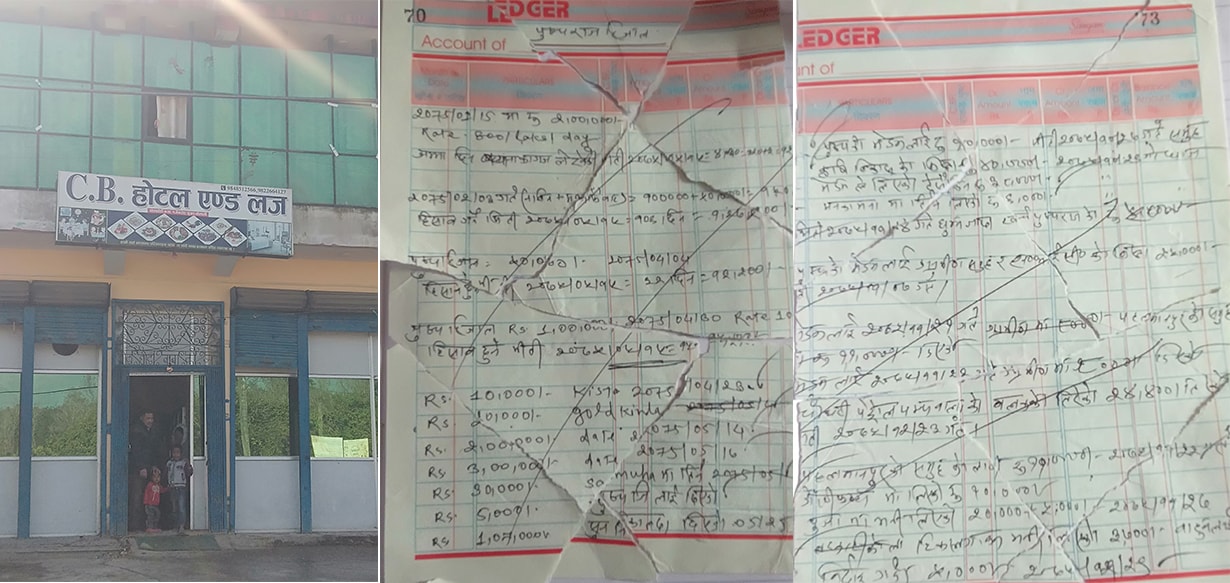

Parashuram Chaudhary, a farmer and businessman from Nakfoduwa, decided to open a petrol pump near his home along the Pahalmanpur-Bhajani road. He believed the pump, seven kilometres away from the main bazaar, would yield good profit. However, he needed capital to begin business.

He took a loan of Rs2.5 million from Ekendra Aer, a businessman from Ghodaghodi Municipality-1. He kept land belonging to his uncle Likhiram Chaudhary and brother-in-law Ramdas Chaudhary as surety. Both the uncle and the brother-in-law agreed to give the land as surety as they could also get to use some money without paying any interest. The interest, which Parashuram would pay entirely, was fixed at 36 percent a year.

Having no other means of earning, Parashuram had a hard time paying an interest of Rs75,000 per month. So he took a further loan of Rs1 million from Pradeep Khanal by keeping the land of his maternal uncle Makkhuram Chaudhary as surety. Makkhuram took Rs2 lakh, and the rest was spent towards paying the interest.

The petrol pump came into operation, but Parashuram had to take a loan again to purchase petrol. This time, he took a loan of Rs5 lakh at the rate of 120 percent a year, spending Rs8 lakh in interest itself that year.

A transaction deed signed between Holiram Chaudhary and Rajesh Thapa.

“I was planning to repay the loan after making a profit from the petrol pump, but that didn’t happen. So I sold the petrol pump along with 3 kathhas of land for Rs6 million,” said Parashuram.

The buyer of the petrol pump gave the money to the lenders Ekendra Aer and Rajesh Thapa directly. And yet, Parashuram has failed to clear the dues. “I paid Rs8.7 million for a loan of Rs2.5 million, and I have nothing left with except my home.”

Aer sold a total of 2 bighas and 4 katthas of the land kept as surety, at the rate of Rs1.85 lakh per kattha last year. Parashuram is now worried about returning the land of his maternal uncle, paternal uncle and brother-in-law.

Aer, on his part, said Parashuram had deceived him by not paying the loan in time. While claiming that he had not been acting as a loan shark, Aer said Parashuram ran a disinformation campaign against him.

Discrepancy on paper

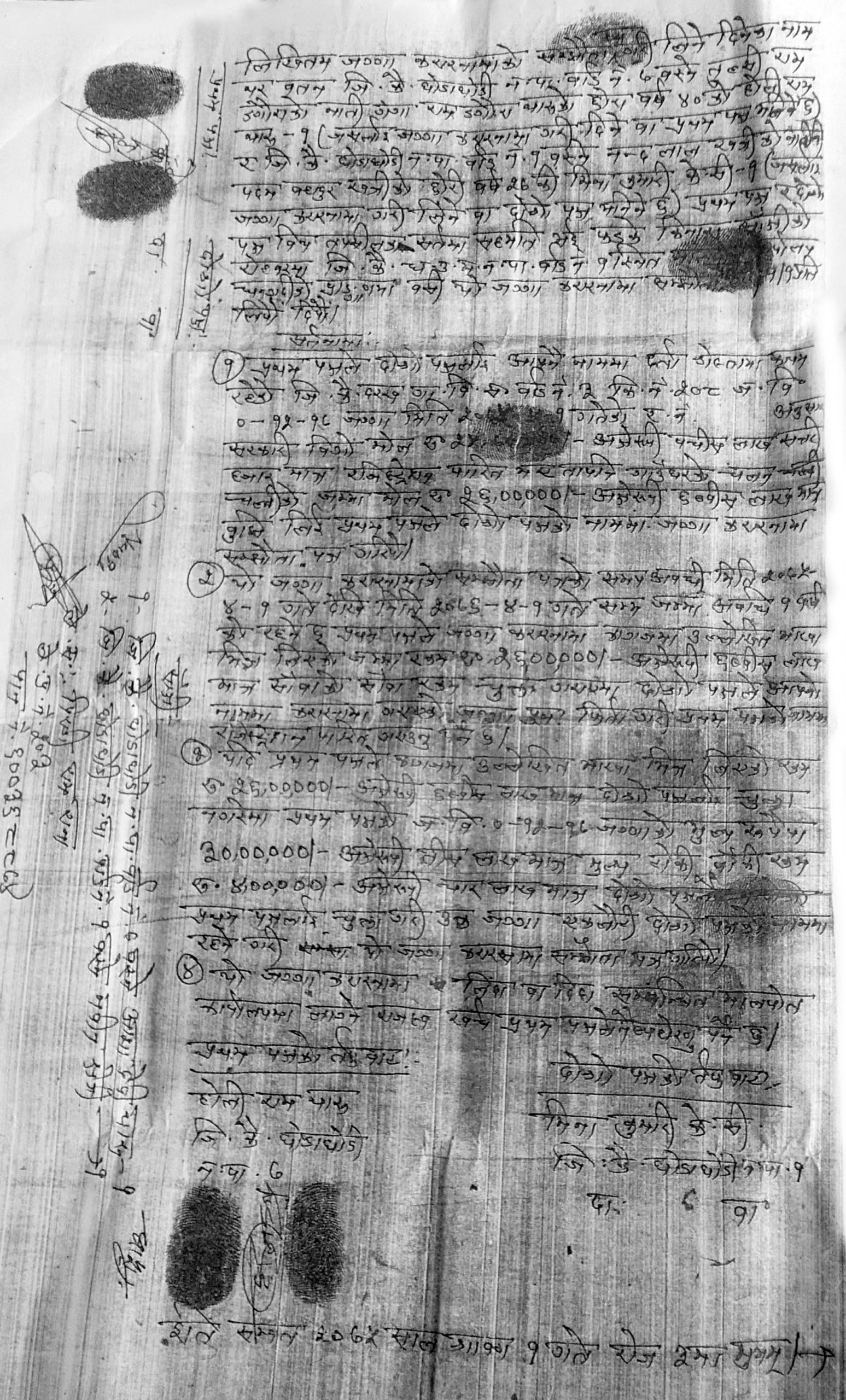

Holiram Chaudhari, a resident of Ghodaghodi Municipality-7, required Rs8 lakh to complete the house he was building. He did not want to go through the lengthy process of acquiring the money through a bank. So he contacted Rajesh Thapa (who had loaned money to Parashuram at the rate of 120 percent a year). Holiram took Rs18 lakh from Thapa at a rate of 36 percent a year, for which he transferred 12 kattha of land to Thapa on the condition that Thapa would return the land within a year once Holiram repaid the loan. The loan deed mentioned the loan amount to be Rs2.6 million.

The deed, signed by Holiram and Thapa’s wife Meana Kumari on 1 Saun 2075, mentioned that the price of the land was Rs3 million. If Holiram could not pay Rs2.6 million within a year, Thapa could pay him Rs4 lakh and keep the land. (See loan deed).

According to Asha Devi, Holiram’s wife, “When I went to repay the loan after selling two kattha of land, I got to know that the loan amount was Rs2.6 million.” A witness for the loan deed, Asha Devi told CIJ that she had signed the deed without reading it when asked by her husband, as she was busy at work at the time.

Pushpa Rijal’s house in Sukhad Bazaar, which is now in Rajesh Thapa’s possession.

Asha Devi said Thapa has already received Rs1.5 million as loan repayment and interest but is still asking for Rs2.1 more. “We have been paying in time, but how can we pay Rs2.1 million now?” said Asha Devi. “Even if the lender is trying to usurp our land, he should return us the Rs1.5 million we have paid him along with interest,” she added.

According to Holiram, the market price of the land, which is 200 metres away from the Bhajani road, is Rs2 lakh per kattha.

According to Asha Devi, the loan amount has become a bone of contention in the family. Their son, who used to study in Kathmandu, has returned home. Holiram drinks a lot and keeps getting sick.

The lender, Rajesh Thapa, on his part, told CIJ that he had helped those in trouble and that he had taken the interest as per the market rate. He conceded that he had loaned Rs1.8 million to Holiram. The amount of Rs2.6 million mentioned in the loan deed included the interest for a year. “No matter what is written on paper, the understanding was that they would return the loan within six months and pay me interest as per the market rate,” said Thapa.

Another person to be victimised by Rajesh Thapa is Pushpa Rijal, a resident of Sukhad. Rijal operated a business named Prashant Suppliers from 2068 to 2075 BS. Today, he works as a plumber.

According to Rijal, he had to pay business tax amounting to Rs4 lakh, and so he took a loan of Rs2 lakh, promising to pay interest at the rate of a thousand rupees a day per one lakh rupees.

After that, Rijal tool loans of Rs10,000 or Rs20,000 time and again. When he could not return the money borrowed at a high interest rate, Thapa started pressuring him to sell the house located at Sukhad.

“I had to pay Rs15 lakh to the bank, and Thapa kept pressurising me to sell the house,” Rijal said, adding, “I sold the house to Nripa Baduwal at Rs4.75 million, but I did not receive the money.” Rijal said that he repaid the loan at the bank and paid the rest of the money to Thapa.

Having lost his property to a loan shark, Rijal started working as a plumber.

When CIJ contacted Thapa, he said he had bought Rijal’s house for Rs5.2 million when the latter failed to repay the loan. “He was hiding inside the house due to the burden of the loan. The bank was going to auction his house. So I helped him pay the bank loan,” Thapa said, adding that he also recovered the loan from Rijal.

Most victims come from the Tharu community

In Kailali district, most of the people who lose their property to loan sharks come from the Tharu community. Those who take loans from loan sharks to do pay bank loans, start business or provide education to children do not keep a proper record of their loans. Since they depend on oral commitment rather than record, the Tharus have become the victims of loan sharks, said Parna Chaudhary, ward chairperson of the Ghodaghodi Municipality-12.

“Even those who have ancestral property have ended up losing their property due to luxurious life, even putting their relatives in trouble,” Parna said, hinting at Parashuram Chaudhary.

A petrol pump established by Parashuram Chaudhary, which is now in Bishal Tiwari’s possession.

According to Chhabilal Tiwari, a lawyer based in Sukhad, most people who come to his office to prepare documents for financial transactions come from the Tharu community. He said the loan sharks targeted those who had ancestral property but did not have other means of income. However, he said, the activities of loan sharks have come down after the local government was constituted. For Tiwari, the fact that any written record of financial transaction needs a member of the ward as a witness and that the law has been strengthened, there has been a decline in the number of unjust transactions.

Kailali chief district officer Kiran Thapa said the Tharu community could have been seen as the biggest victim of this problem because Tharus heavily populate the district.

Banking transactions are not up to the mark

What could be the reason for a significant number of people falling in the trap of loan sharks even when banks have reached villages? Those who have become victims of the loan sharks said they found the banking system difficult and unsuitable for them. They said the banks did not give them loans in time, the documentation system was difficult, the banks asked for an excessive amount of surety, and provided a comparatively smaller amount of loan.

“The banking process is too long, and we don’t understand what they say,” said Parashuram Chaudhary, who lost his property to a loan shark. “I got the loan from an individual easily, and I could not think clearly, so I took a loan at a high rate of interest.”

According to Yagya Prasad Sapkota, a loan officer at the Agricultural Development Bank, the loan process takes just between three and seven days. “Those who needed money immediately could have taken loans from loan sharks,” said Sapkota, who worked at the Sukhad branch of the bank for three years.

Since the bank checks not only the surety but the borrower’s source of regular income and ability to repay the loan, they could have found it difficult to seek loans from the bank, said Sapkota.

Local government remains indifferent

Mamta Prasad Chaudhary, Chief, Ghodaghodi Municipality.

According to Jeet Bahadur Thapa, chairperson of the Dhangadhi Chamber of Writers, the trend of people losing the property to loan sharks had seeped into villages apart from places such as Dhangadhi, Tikapur and Ghodaghodi. “There are several cases of people becoming homeless, leaving the country, or committing suicide,” said Thapa. However, neither the victims complain against the loan sharks, nor does the local government attempt to end the problem.

According to Bishwa Adhikari, Superintendent of Police and chief of District Police Office Kailali, his office had not received any complaints as these issues do not fall in the jurisdiction of the police. However, he said, the victims can come to them to submit a complaint if they do not have evidence to submit to the court. “However, no one has come to complain to us against a loan shark,” said Adhikari.

Chief District Officer Kiran Thapa said his office had not received any complaint yet, although he has heard about loan sharks. “It seems that the local government should run awareness campaigns in towns and villages to ensure that people do not take high-interest loans by keeping their property as surety,” said Thapa.

Ghodaghodi Municipality mayor Mamata Prasad Chaudhary said nobody had come to his office with a written complaint, although the entire village had been victimised. Although victims had approached him, Chaudhary had failed to take any initiative to stop the trend. “I have also spoken with the chief district officer on this issue,” said Chaudhary.

According to Parna Chaudhary, ward chairperson of Ghodaghodi Municipality-12, “Both the victims and the victimisers belong to the same village. We do not recommend the sale of a piece of land if we get to know that the land has been used as a surety for loan,” said Chaudhary.

According to Laxmi Prasad Bhattarai, associate professor at Ghodaghodi Multiple Campus, many families he knows have fallen apart due to the problems created by loan sharks. “Those who do such transactions even when they know these are illegal have become the victims. That is why they can’t even complain,” said Bhattarai, adding, “Big businesspersons, educators, and social elites are involved in this practice.” He advised that the local government’s judicial committee should invite open invitations from those who have been the victims of loan sharks and make attempts to solve the disputes.