Four years back CIJ report exposed how government’s Youth Self-employment Fund, set-up to help unemployed youths kick-start their own business was being funneled to fund local politics. Our new investigation shows, situation hasn’t changed at all.

KALPANA BHATTRAI- Centre for Investigative Journalism

In 2008 the Maoist-led government announced ‘Youth Self-Employment Fund’ program to provide un-mortgaged loans of up to Rs 200,000 at low interest rates to unemployed youths for setting up their own business. The objective of this program was to ease the growing pressure in the jobs market, by helping skilled youths who cannot find jobs to self-employ and start their own business.

Ineligible and Eligible: Manager of Srijana Savings and Co- Operative Ltd Hari Prasad Bashyal who received loan from the co-operative and local youth Khemraj Gautam who did not get the loan of 1.5 lakh.

Swastik Savings and Loans Cooperative Ltd. of Nawalparasi district, one of the intermediary chosen for disbursement of loan from this fund has been funding a cow farm for the past five years. In 2012, Swastik received Rs 3 million from the fund, out of which it invested Rs 1.8 million on the farm.

‘The executive board decided to invest the money on the farm which was running on loss.’ admitted Tara Neupane, manager of Swastik. ‘The first two installment was invested in the farm in the name of our shareholders as a group loan while the third installment of Rs 1.2 million has been invested in other livestocks.’ revealed Neupane.

On paper, the money received from the fund has been disbursed to the shareholders. But many members are not aware they are collecting debts.

When asked, Swastik’s Chairperson Dev Raj Bhandari defended board’s decision saying, ‘Everybody will earn profit, nothing wrong in that.’

The fact that Swastik created loonies on paper and funneled the fund in the names of its own staff, families of the government employees overseeing its use, points at systemic embezzlement of self-employment fund.

In the name of the poor

Mission Development Bank, whose central office is in Butwal, is another intermediary which took subsidized loan from the fund to invest in self-employment projects of youths in Nawalparasi and Rupandehi. But instead, it reached out to proprietors and established corporate business houses, making huge profits through difference in interest rates.

‘The bank was offering an attractive deal for me, so I took it’, says Narayan Pandey, who operates Star Computer Institute and Training Centre in Ramnagar – 1, Bhumahi.

We found, the banks were reluctant to provide loans to the unemployed youths and their new ventures due to fear of losing their investments, and preferred investing in established business or giving loans to people they knew. As a result, the fund has not reached who it was actually intended for.

Tara Pandey of Ramnagar-8, Nabin Tol, received loan from Swastik Cooperative on account of his ‘good performance’. Pandey is the manager of the cooperative. ‘I am aware that employees are not eligible to apply for the fund money, but I needed money to pay my debt.’ says Pandey.

Similarly, Mina Chhetri was also lucky to have received the subsidized loan. ‘I was looking for some money to buy a piece of land, so I applied for the fund loan stating that I was going to invest in livestocks.’ admits Chhetri.

Basanta Subedi, who teaches at Motilal Multiple Campus and Yagyamurti Bhandari, who works at District Statistical Bureau in Gorakha have also received loan from the fund. Bhandari, who was a school teacher at Somnath High School when he took the loan, now says, ‘I forgot why I took that loan and don’t recall how i spent it either.’

In Nawalparasi district alone, Rs 100 million of fund money has been invested through 18 cooperatives and two banks. Although the fund is intended for unemployed youths, reviewing the list of current loanies suggests, those actually benefitting from it are people with established business and jobs. This means, youths who have innovative ideas and zeal for self-employment end up being excluded.

Local teacher Prabin Bhattrai of Khani Gaun Lower Secondary School received loan against fund's regulations

In 2011, Sana Kisan Development Bank invested Rs 100.24 million into 14 small-scale farmers’ cooperatives in Nawalparasi and Rupandehi district. But, Area Manager Sher Bahadur Chaudhari admits says, the program has been ineffective. ‘The problem is, government wants us to grant the loan money to the poor, the unemployed, and to those who have nothing. This does not make business sense.’ says Chaudhari.

So, the banks and other intermediary organizations are providing loans to those who already have jobs, influence, and reach. In return, they are raking huge profits abusing the subsidy. Needless to say, this violates the Youth and Small Business Self-Employment Fund Act 2065, both in letter and in spirit.

Kamal Prasad Sapkota, who heads the legal department overseeing the government’s fund program insists, the subsidy money has not been abused and assured us, ‘I will not let taxpayers’ money be abused. If the cooperatives and banks have done anything wrong, will be brought to books.’ But, Sapkota’s claims fall to face when you see what is happening in Nawalparasi and other districts.

We found, Palpa’s Srijana Savings and Loans Cooperative has also been doling out soft loans to people who are in its good graces. Kushan Bahadur Gaha Magar, Shanta Neupane, Kamala Debi Gaire and Yagya Prasad Basyal have received loans several times, against the stipulated regulations.

On the other hand, Khem Narayan Kafle of Rampur – 7, who runs a small pharmacy shop could not get the fund’s loan to expand his business because he did not have anything to mortgage. Kafle is from Syangja and has been living in Palpa for the last 8 years.

Khem Raj Gautam of Rampur – 10 also did not get the loan because he did not have anything to mortgage either. ‘I thought they were providing loans to the poor and needy youths to start business. We would not be poor and needy if we had anything valuable to mortgage, would we?,’ asks Gautam.

Dipendra Paudel, who runs a cooperative, claims they are forced to seek mortgages because they fear for their investments. Dipendra’s fears may be valid, but it is also true, his cooperative took the Rs 5 million of fund money agreeing to lend it to the needy youths without a mortgage.

Surya Prasad Pageni, 43 years, of Rampur – 5 asked for Rs 200,000 to run a meat shop and a poultry farm. He got only got Rs 150,000, that too after agreeing to mortgage his property.

Andhakar Mukti Savings and Loans Coopeartive, which provided loan to Pageni wrote to the land administration offices to stop transactions on Pangeni’s land before disbursing the money, but lied about the loan amount. Official loan papers state that he took a loan of Rs 500,000, but Pageni was only given Rs. 150,000. At the time his loan was sanctioned, he had no idea about the inflated amount. The cooperative’s Manager Keshab Pageni accepts that they had been inflating the loan amount.

Sirjana Savings’s Manager Hari Basyal has also taken a soft loan from the fund. He has taken Rs 100,000 in 2014, to buy new equipments for his television cable business, which he has been running along with his classmate Yubaraj Gaire.

‘I became manager of the cooperative much after taking the loan.’ Basyal told us. But records show, he has been a manager there for the last three years.

No one speaks up

Sana Kisan Bikas Bank’s Butwal branch has invested Rs 100.23 million in 14 small-scale farmers’ cooperatives in Nawalparasi and Rupandehi. Among these, Sana Kisan Krishi Sahakari Sanstha of Kumarbarti, Nawalparasi, invested Rs 3.3 million on 25 people between 10 July 2011 and 19 June 2013.

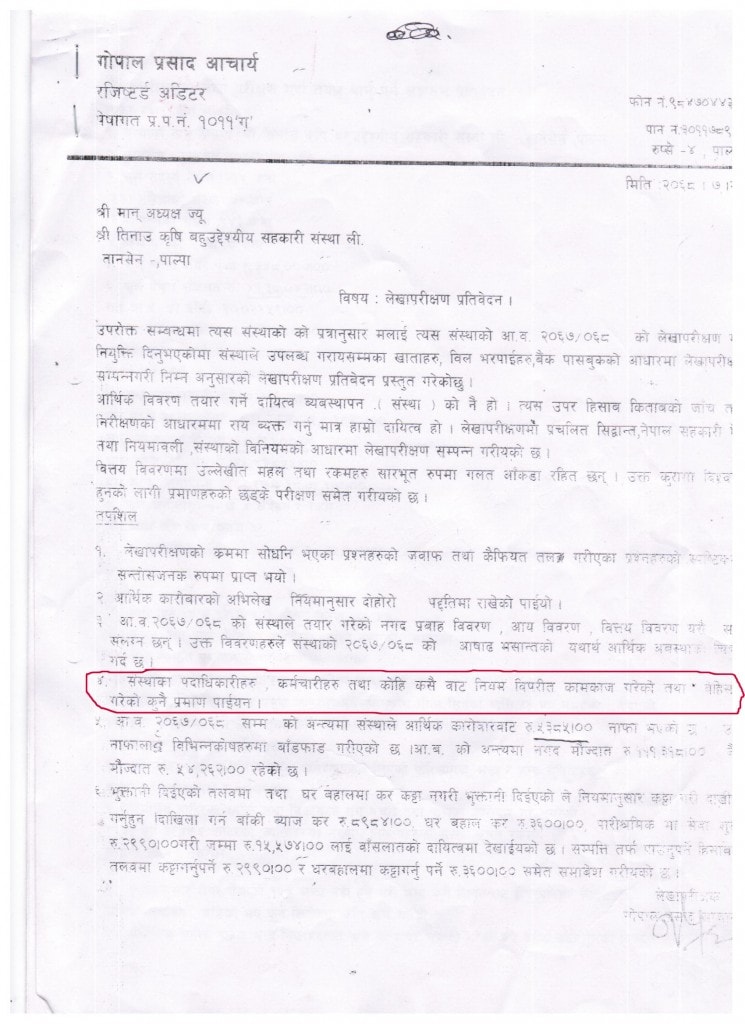

Audit report for Tinau Multi-purpose Co-operative submitted by auditor Gopal Prasad Acharya. His report failed to point at financial irregularities despite wrongdoings by the company's high ranking officers.

Paropakar Swabalamban Savings and Loan Cooperatives also invested Rs 4.5 million on 30 youths. But like elsewhere, the program became ineffective due to weak monitoring. Like Chaudhary cooperative’s manager Gobinda Bahadur Rayamajhi too blames it on weak monitoring by the volunteers.

Fund’s Information officer Lok Bahadur Khadka told us that the program has so far invested Rs 3.49 billion through 28 banks and 624 cooperatives in 73 districts. He also informed us that the program pays Rs 5000 every month to one volunteer in each district for monitoring progress and effectiveness of the program.

But Krishna Darnal, who is the district volunteer for Palpa defends himself, ‘How can we monitor the entire district on our own? The state has delegated us too for too little.’ Darnal is Palpa district correspondent for the state’s news agency Rastriya Samachar Samiti and works.

According to the fund’s stipulated regulations, the banks, financial institutions, cooperatives, along with fund’s employees and District Coordination and Monitoring Committee are collectively responsible for monitoring the use and recovery of fund’s loan.

Prakash Acharya of Divisional Cooperative Office, who has attended all of the meetings called by Nawalparasi District’s Coordination and Monitoring Committee admits, ‘We found the cooperatives have been operating against the fund’s regulations. But we have not spoken out, if we do, the entire program suffers.’

Basudev Bhattarai, Chief at the Divisional office pointed at the regulatory gap: ‘Our mandate is only to check if the cooperatives are working under our guidelines. We do not have the authority to decide whether their activities are pursuant to the fund’s regulations or not.’

There is another five-member monitoring committee under District Union of Commerce and Industry, but the body is barely functional as the fund’s activities does not seem to fit in to the priority of its members.

Forged audits

We also found that the cooperatives have been forging audit reports inorder to receive loans from the fund. Palpa’s Tinau Multi-purpose Agriculture Cooperative submitted forged audit reports for the year 2011/12 in order to get Rs 1.05 million in loan.

The company’s audit report for the year shows that the company had collected Rs 4.13 million in savings, when its total paid-up capital is mere Rs 348,000. The company also lied that it earned only Rs 5,385 in profits during the fiscal year. The fact that the report does not bear signatures of the auditor and the company’s treasurer, and is neither stamped, indicates that the documents may have been forged.

The company’s audit report for the year shows that the company had collected Rs 4.13 million in savings, when its total paid-up capital is mere Rs 348,000. The company also lied that it earned only Rs 5,385 in profits during the fiscal year. The fact that the report does not bear signatures of the auditor and the company’s treasurer, and is neither stamped, indicates that the documents may have been forged.

District Chair or Nepal Auditors Association for Nawalparasi, Ramji Gyawali admits that the document is suspicious.

Inconsistencies don’t end here. According to Nepal Chartered Accountants Act 2053, any individual or organization authorized to carry out institutional audit has to be licensed by Nepal Chartered Accountants’ Organisation. But we found, Auditor Gopal Prasad Acharya who had audited Tinau’s accounts had not renewed his license, numbered 1011 Ga.

After being embroiled into forged audit scandal, Tinau has closed its office in Asantol. Its clients have lost their savings and are now left in the lurk. According to Pushkar Bhattarai, chief of Palpa’s Divisional Cooperative Office, at least Rs 1.2 million of the fund’s money is yet to be recovered.

Among the 19 people who have taken loan from the cooperative, most are Maoist cadres who now belong to different factions. The cooperative has also yet to return Rs 1.7 million savings to its clients. Worryingly, in mid-June 2015, accounts showed a loss of Rs 1 million which could have doubled by now. The total capital of the organization is Rs 407,000.

Because its working capital is low, loans are high and the accounts are forged, Tinau is unlikely to get back on its feet. Its manager Dipak Giri says they cannot return money to their clients because the loan-takers have not paid back.

‘We could not put the Rs 1 million we received from the fund to proper use.’ regrets Giri. Chairman Makbul Ali says, the company is working hard to get the money back to their clients. ‘We’ve had several meetings after receiving complaints, and are trying hard to raise the money as quickly as we can.’ He blames Manager Giri for deliberate wrongdoing.

The Youth Self-Employment Program was established with much fanfare and fancy sloganeering, promising to create employment for the poor, resource-less and the unemployed. But it failed to live up to its purpose, funding the resourceful instead, who benefitted from subsidized loans. The program also failed miserably, falling in the hands of greedy rather than the needy.

In their name: Loan defaulters who had no idea the company had issued loans in their name.

|

Name |

Amount |

Use |

|

Chanaranwati Chaudhari |

Rs 200,000 |

Collective buffalo-farm |

|

Indira Neupane |

Rs 200,000 |

Collective buffalo-farm |

|

Krishna Thapa |

Rs 200,000 |

Collective buffalo-farm |

|

Sumitra Pandey (teacher at Baba Bardagoriya Elementary School) |

Rs 200,000 |

Collective buffalo-farm |

|

Ganga Chapagain (wife of manager of Sana Kisan Krishi Cooperative) |

Rs 200,000 |

Collective buffalo-farm |

|

Tara Kumari Gaire |

Rs 200,000 |

Collective buffalo-farm |

|

Jiba Lal Neupane |

Rs 200,000 |

Colective cow-farm |

|

Sita Dhakal |

Rs 200,000 |

Collective cow-farm |

|

Khuma Bhattarai |

Rs 200,000 |

Collective cow-farm |

|

Lila Devi Pandeya |

Rs 200,000 |

Collective cow-farm |

|

Chakramani Chettri |

Rs 100,000 |

Collective cow-farm |

|

Chudamani Neupane |

Rs 200,000 |

Collective cow-farm |

|

Sunita Dhakal |

Rs 200,000 |

Collective cow-farm |

|

Karuna Kunwar |

Rs 200,000 |

Collective cow-farm |

|

Rajesh Prasad Tharu |

Rs 200,000 |

Collective cow-farm |

|

Saraswati Panthi |

Rs 200,000 |

Collective cow-farm |

Source: Swastik Savings and Loans Cooperative Limited